Analyst Charting Guy notes that key resistance lies between $1.20 and $1.40, where multiple moving averages and red trendlines converge. A decisive breakout above this zone, supported by growing trading volumes, could confirm the end of an ABC correction and trigger a powerful Elliott Wave third-wave rally toward $4–$5.

According to analyst TOP GAINER TODAY, the meme coin’s market cap of $959.86 million and daily volume of $354.56 million highlight strong participation. Maintaining support above $0.50 and clearing the upper triangle boundary remain critical for a sustained bullish reversal and significant upward momentum.

Weekly Price Chart Forms Key Levels

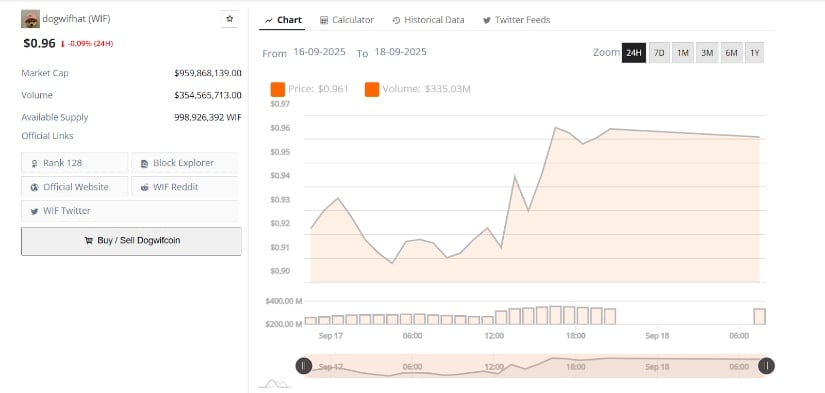

Dogwifhat traded near $0.96 after a mild early-session dip. The token moved between $0.90 and $0.96 over the past 24 hours. Its market capitalization stood around $959.86 million, supported by a trading volume of $354.56 million and an available supply of 998.92 million WIF. Buyers stepped in during midday trading, lifting prices steadily higher and leaving the crypto consolidating at the upper end of its daily range.

WIFUSD 24-Hr Chart | Source: BraveNewCoin

Price action showed a gradual upward recovery following an early decline. An afternoon rally pushed the token to $0.96, where it stabilized into the close. Volume spikes during the move indicated stronger market participation and stronger defense of higher support levels. Traders now watch the $1.00 level, considered a psychological resistance, while the $0.92–$0.94 zone serves as immediate support to sustain the trend.

Key Resistance Zone and Elliott Wave Structure

Analyst Charting Guy noted that WIF is approaching a critical resistance band near $1.40. The weekly chart displays converging red horizontal and diagonal trendlines in that region, together with intersecting moving averages. These factors create a strong technical barrier that must be surpassed to validate an extended upward move.

WIFUSD Chart | Source:x

Charting Guy pointed to an Elliott Wave structure suggesting the recent ABC corrective phase may have ended. The setup signals potential for a new impulsive wave, labeled as the third in the sequence. Based on this technical pattern, a successful breakout above $1.40 could open a path for the meme coin to reach between $4 and $5 over the next market cycle.

Symmetrical Triangle Signals Potential Breakout

A separate weekly analysis of the WIF/USDT chart on Binance shows price compressing inside a symmetrical triangle. The token has repeatedly held an ascending trendline rising from below $0.50 while facing resistance along a descending upper trendline near $1.20. The current weekly candle remains around $0.92 as the trading range tightens, indicating a buildup for a decisive movement.

According to analyst TOP GAINER TODAY, an upward break from this triangle could initiate a rally toward $5. The chart projection includes historical resistance checkpoints around $4.0 and $5.0. A weekly close above $1.20–$1.50 with strong volume would help confirm a bullish reversal from the months-long base and support the Elliott Wave outlook shared by Charting Guy.

Market Outlook and Support Levels

The prevailing market structure suggests traders are watching two critical levels. The $1.20–$1.50 band forms the main resistance zone that must be cleared to confirm the anticipated upward wave. Beneath current prices, the ascending trendline starting near $0.50 provides an important base of support. Holding this level will help preserve the developing bullish setup.

Short-term action focuses on whether the $1.00 threshold can be crossed and maintained. Sustained buying interest and elevated trading volumes are key metrics for a potential breakout. A weekly close above the upper boundary of the triangle could signal the start of a new market phase, keeping the Elliott Wave target of $4–$5 in view for upcoming sessions.

1 hour ago

4

1 hour ago

4

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·