Latin America’s Digital Banking Giant Explores Stablecoins and Crypto Payments

nubank, Latin America’s largest digital bank, is reportedly working on integrating dollar-pegged stablecoins and credit card payment options. This strategic move signals a significant push towards blending traditional banking with blockchain technology to enhance financial services across the region.

The announcement came from Nubank’s vice-chairman and former Brazil central bank governor, Roberto Campos Neto. During the Meridian 2025 event on Wednesday, Neto emphasized the growing role of blockchain in bridging digital assets with conventional banking systems. According to local reports, Nubank plans to initiate testing of stablecoin payments linked to its credit cards as part of a broader initiative to facilitate digital asset adoption within banking services.

“What the data shows is that people aren’t buying cryptocurrencies for transactions, but rather as a store of value,” Neto remarked, highlighting shifting consumer behaviors. “And we need to understand the reasons behind this trend. It’s changing, but it’s crucial to grasp what’s driving it.”

Neto also acknowledged the challenges faced by banks in accepting tokenized deposits and leveraging these digital assets to extend credit to customers. Such innovations could revolutionize traditional banking models by enabling secure issuance of loans based on digital assets.

Founded in São Paulo in 2013, Nubank currently serves over 100 million customers in Brazil, Mexico, and Colombia. The bank’s approach to digital assets has been progressive; in 2022, it allocated 1% of its Net Assets to Bitcoin and launched crypto trading for customers. Expanding its crypto portfolio further, Nubank in March 2025 added four altcoins—Cardano, Cosmos, Near Protocol, and Algorand—providing users with more diverse options for digital asset investments.

Surging Stablecoin Adoption in Latin America

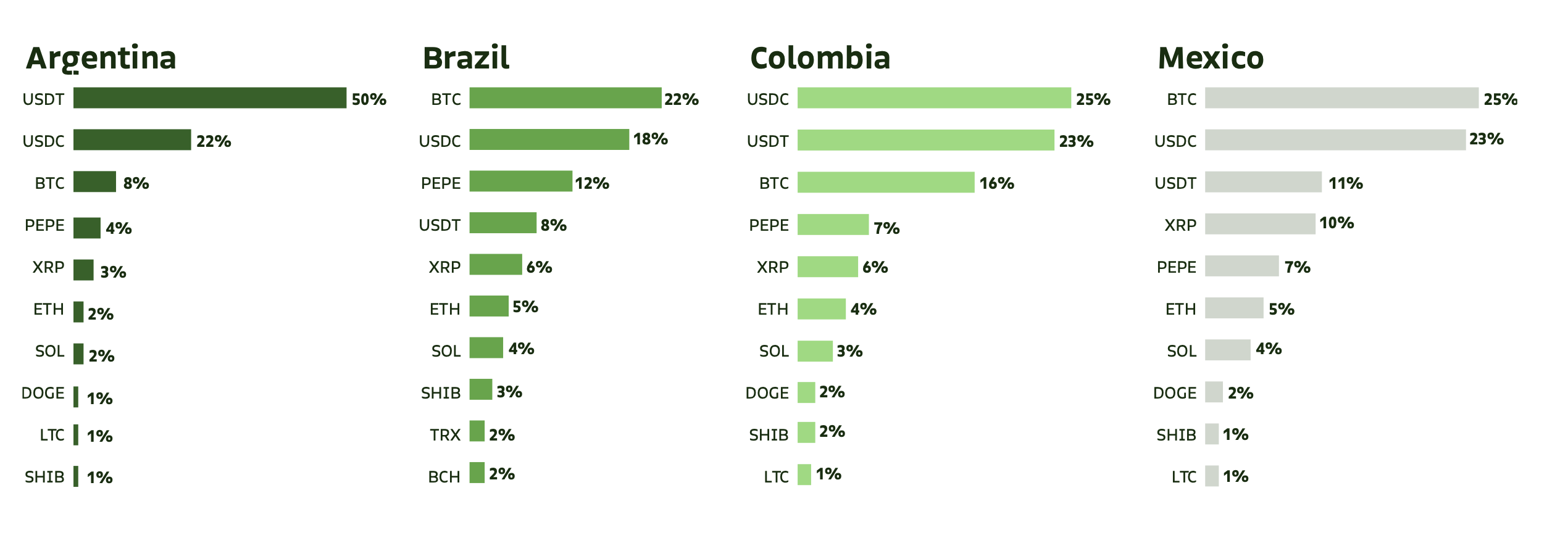

Stablecoin use is soaring across Latin America, especially in Brazil, where the Central Bank reported that 90% of crypto activity is linked to stablecoins. In Argentina, dollar-pegged assets like USDT and USDC have gained traction amid inflation surpassing 100%, serving as a vital store of value for local residents.

According to a March 2025 report, stablecoins accounted for half of all cryptocurrency transactions in Brazil in 2024, with USDT and USDC making up the majority of crypto purchases in the country. This trend underscores the increasing reliance on digital dollars to preserve wealth amid economic instability.

Purchasing behaviors across Latin America in 2024. Source: Bitso

Purchasing behaviors across Latin America in 2024. Source: Bitso

Other countries like Bolivia and Venezuela are also increasingly embracing crypto. Bolivia signed an agreement with El Salvador in July 2025 to promote crypto as a reliable alternative to fiat, especially after lifting its crypto ban in June 2024. In Venezuela, where inflation has soared over 200%, stablecoins such as USDT have become common for everyday transactions, including salaries and groceries. Chainalysis data shows stablecoins accounted for nearly half of crypto transactions under $10,000 in 2024, highlighting their vital role in Latin America’s volatile economic landscape.

This article was originally published as Nubank Announces Stablecoin Integration to Revolutionize Credit Card Payments on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

1 hour ago

11

1 hour ago

11

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·