TLDR

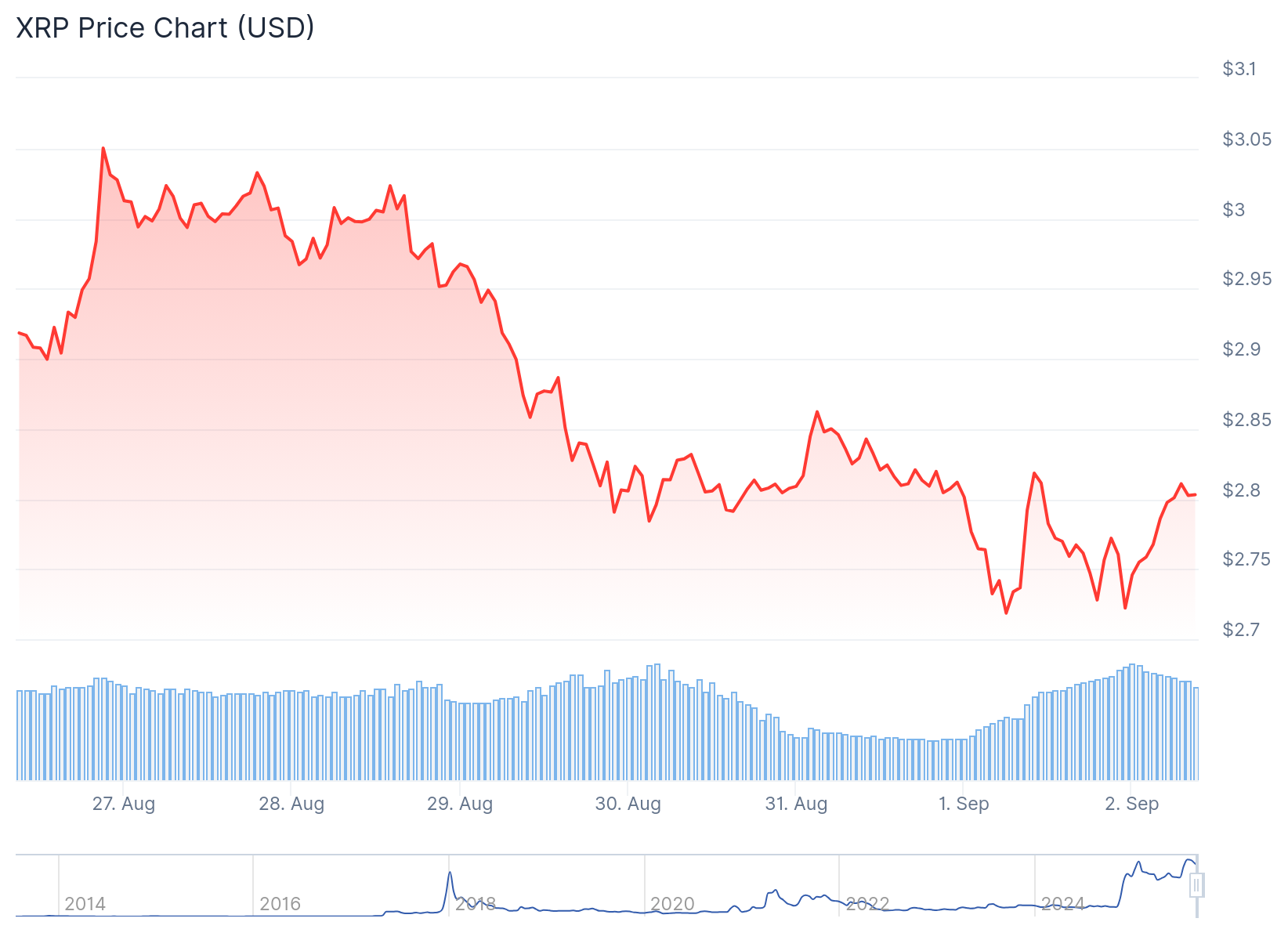

XRP price dropped 1.78% to $2.78, extending losses from last week’s sharp sell-off Active addresses on XRP Ledger plummeted from 50,000 in mid-July to 19,250 on Monday Futures open interest declined from $10.94 billion to $7.7 billion, showing reduced investor conviction Technical analysis shows descending triangle pattern with key support at $2.70 that must hold If $2.70 breaks, XRP could fall to $2 target, representing a 25% decline from current levelsXRP price continues to face downward pressure as the token trades at $2.78 following a 1.78% decline over the past 24 hours. The cryptocurrency has been stuck in a bearish trend since reaching multi-year highs above $3.60 in July.

XRP Price

XRP Price

Market sentiment has shifted into fear territory, with the Crypto Fear & Greed Index dropping to 46 from neutral levels seen last week. This change reflects growing investor caution across the broader cryptocurrency market.

The decline in sentiment is backed by concrete on-chain data showing reduced network activity. Active addresses on the XRP Ledger have dropped to approximately 19,250 on Monday. This represents a massive decline from the 50,000 active addresses recorded in mid-July.

Active addresses track wallets that actively send or receive XRP transactions on the network. The sharp reduction indicates decreased user engagement and reduced risk appetite among investors.

Futures Market Shows Declining Interest

The futures market provides additional evidence of waning investor interest in XRP. Open interest has fallen from $10.94 billion to $7.7 billion over recent weeks.

Open interest measures the total value of outstanding derivative contracts. Declining OI typically suggests reduced investor conviction and can increase the likelihood of continued downward price movement.

The technical picture presents a mixed outlook depending on key support levels. XRP has been forming a descending triangle pattern since its July rally to $3.66.

This chart formation features a flat support level at $2.70 and a downward-sloping resistance line. Descending triangles that form after strong uptrends often signal bearish reversals.

Critical Support Level at $2.70

The $2.70 support level represents a crucial battleground for XRP bulls and bears. If this level holds, the price could potentially recover toward the upper trendline at $3.09.

A successful break above $3.09 would coincide with the 50-day simple moving average and the 0.618 Fibonacci retracement level. Such a move could confirm renewed bullish momentum.

However, losing the $2.70 support could trigger another wave of selling pressure. The next support zone sits between $2.60 and $2.48, corresponding to the 100-day and 200-day moving averages respectively.

A breakdown below this demand zone could send XRP toward the downside target of approximately $2.08. This would represent a 25% decline from current price levels.

The liquidation heatmap shows clustering of buy orders around the $2.70 level. Large ask orders are positioned between $2.87 and $3.74, creating potential resistance zones.

Short-term technical indicators present a bearish outlook. The hourly MACD is losing momentum in negative territory, though the RSI remains above 50.

On the hourly chart, XRP faces immediate resistance at $2.820, where a bearish trendline has formed. The 100-hourly simple moving average also provides resistance at similar levels.

For any recovery attempt, XRP must first clear the $2.850 resistance zone. Success at this level could open the path toward $2.880 and potentially $2.920.

The Moving Average Convergence Divergence indicator points to a potential bearish crossover in September. This technical signal could support a decline toward the $2.17 level.

XRP price attempted to recover from the $2.70 zone but remains below key resistance levels at $2.850 and the 100-hourly moving average.

The post XRP Price: Fear Grips Market as Token Tests Key Support appeared first on CoinCentral.

4 days ago

3

4 days ago

3

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·