TLDR

World Liberty Financial proposed using 100% of protocol fees to buy back and burn WLFI tokens to reduce supply WLFI price dropped 30% on the day and 36% from its peak of $0.331 to a low of $0.210 Trump family holdings increased to $5 billion after a major token unlock that added 24.6 billion tokens to circulation Short positions dominate derivatives markets with liquidation clusters near $0.28 creating squeeze potential Technical analysis shows bullish divergence pattern with higher price lows while RSI prints lower lowsWorld Liberty Financial has proposed a token buyback and burn program as WLFI price continues to struggle after its recent launch. The Trump family-tied DeFi project wants to use all protocol fees to purchase and destroy tokens from circulation.

World Libery Financial (WLFI) Price

World Libery Financial (WLFI) Price

The governance proposal calls for using 100% of fees generated from protocol-owned liquidity positions across Ethereum, BNB Chain, and Solana. These fees would buy WLFI tokens from the market before permanently burning them.

World Liberty Financial collects trading fees from its protocol-owned liquidity. The project would then use those fees to purchase WLFI tokens from short-term sellers on the open market before sending them to a burn address.

The mechanism aims to reduce circulating supply while increasing the relative ownership percentage of long-term holders. It would create a direct link between platform usage and token scarcity.

WLFI ambassador “Tespmoore” said the proposal favors going all-in on burning instead of splitting between treasury operations and burn. Alternative options like a 50/50 split were considered but not chosen.

The majority of respondents in the comments section voiced approval of the proposal. If approved, this would be the starting point for a broader buyback strategy that could eventually include other revenue sources.

Token Unlock Boosts Trump Holdings

A huge WLFI token unlock on Monday added 24.6 billion tokens to circulation. The unlock increased the Trump family’s holdings to $5 billion in total value.

The project previously said holdings of founders, including Donald Trump and his three sons, would initially remain locked. WLFI now has a circulating supply of 27.3 billion out of 100 billion total tokens.

The token carries a market capitalization of $6.6 billion at current prices. The large unlock event coincided with the token’s initial trading launch on exchanges.

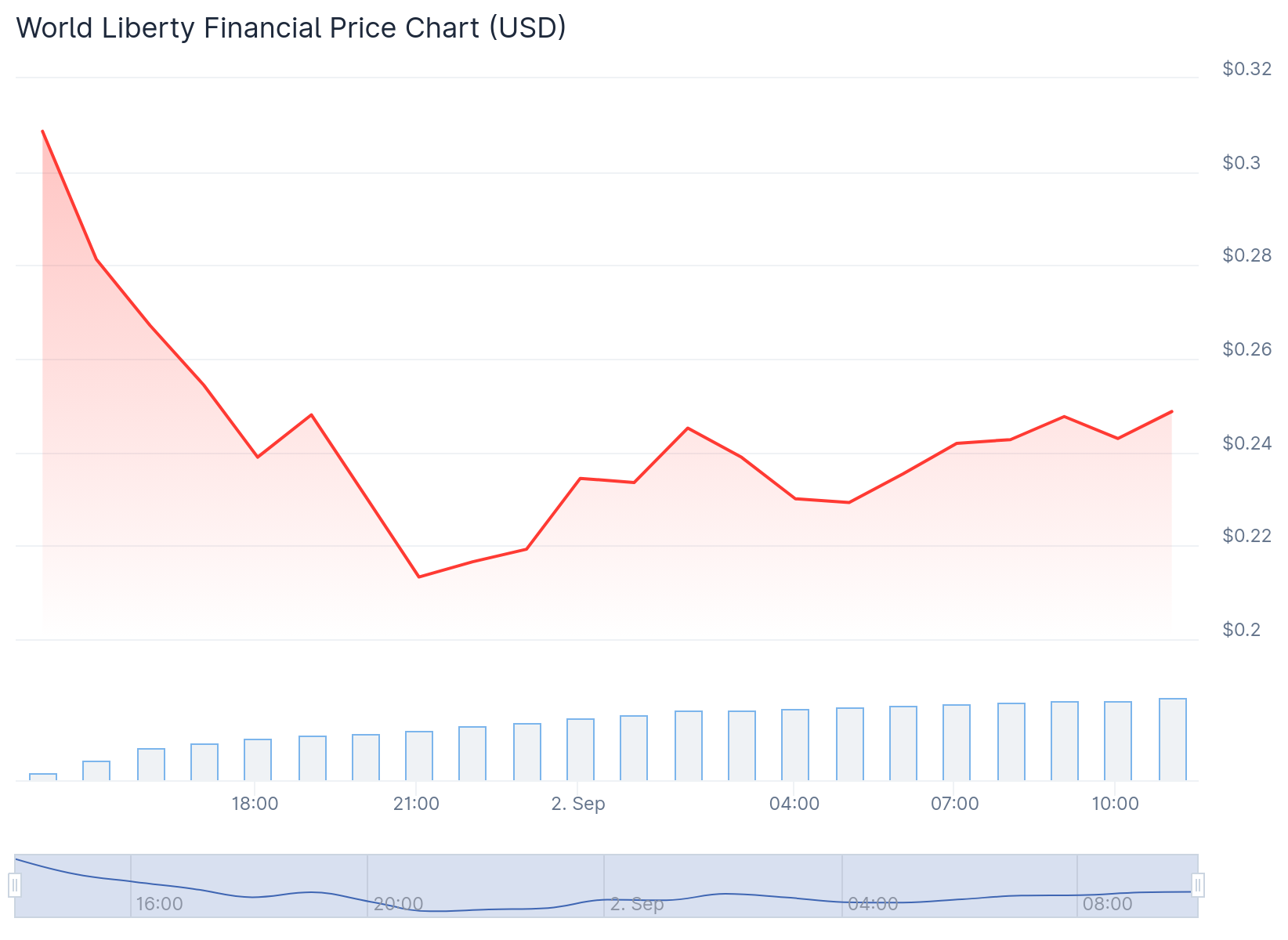

WLFI fell around 36% from the peak of $0.331 to a low of $0.210 before recovering slightly. The token traded at $0.229 at the time of writing, down almost 30% on the day.

Derivatives Show Squeeze Potential

WLFI perpetual contracts have been live since August 23, even before spot trading began. Derivatives positioning shows short positions dominating across major exchanges.

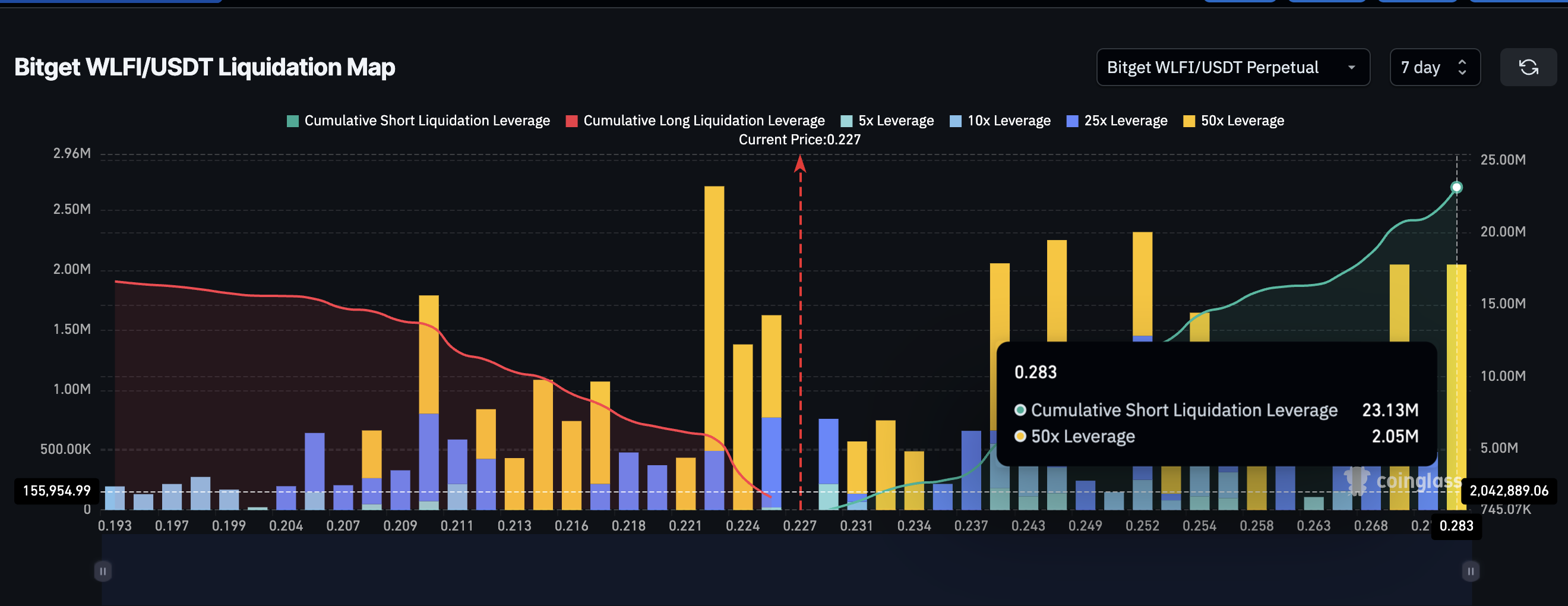

On Binance alone, shorts account for nearly double the long liquidations. At Bitget, short liquidations sit above $23 million compared with just $16.6 million for longs.

Source: Coinglass

Source: Coinglass

Hyperliquid’s seven-day liquidation map shows clusters near $0.28. This creates conditions for a potential short squeeze if WLFI clears that threshold.

The imbalance could force shorts to cover if prices rise, potentially accelerating any rally. If WLFI breaks $0.28, those clusters could unwind quickly and push the token toward $0.32.

However, if the price corrects further, the token could become a long squeeze candidate instead. This would invalidate the near-term bullish outlook for WLFI.

Technical analysis reveals a bullish divergence pattern on the charts. Between August 24 and September 1, WLFI price formed higher lows while RSI extended to fresh lower lows.

This type of divergence across a wider timeframe often signals weakening downside momentum. It creates room for another upside attempt despite current spot market weakness.

Source: Nansen

Source: Nansen

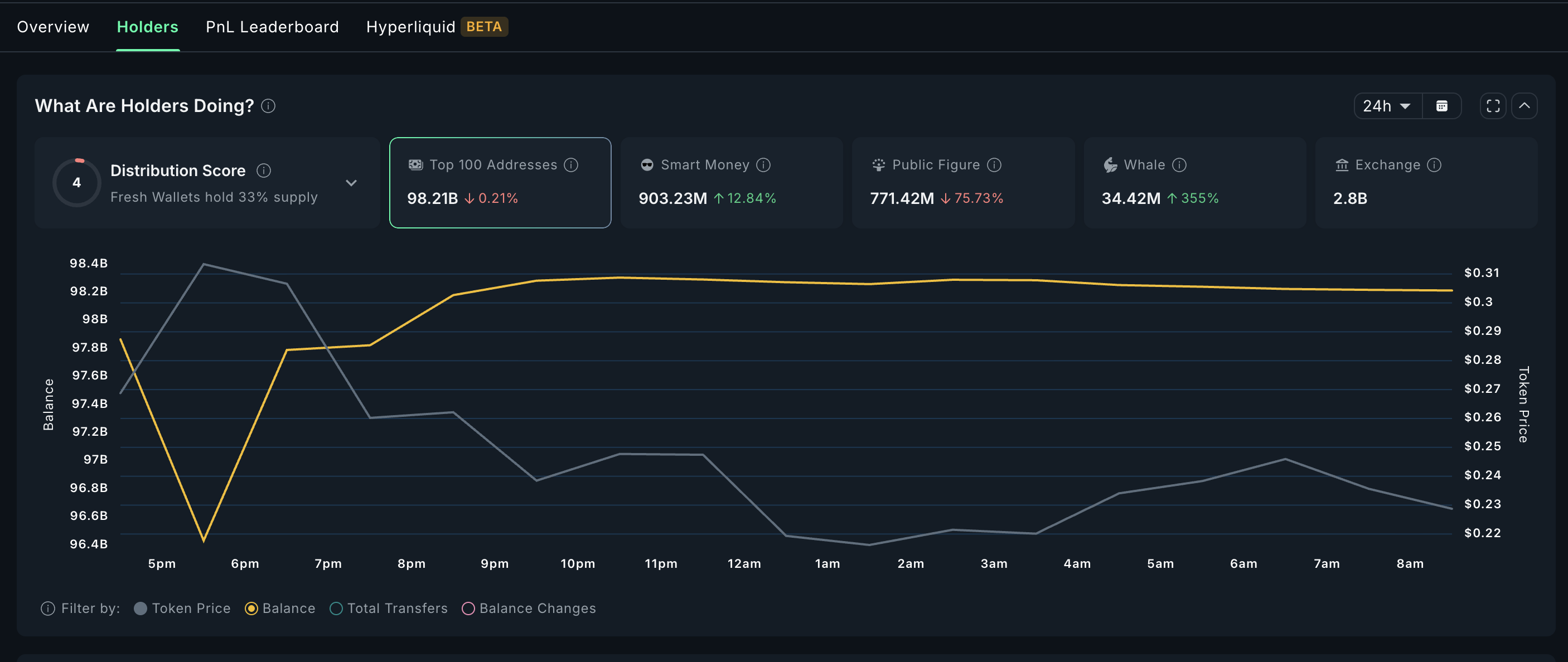

Top 100 addresses offloaded almost 216.54 million WLFI worth close to $49.15 million. Smart money picked up more than 102.78 million WLFI during the same period.

Public figures, including known influencers and market personalities, dumped close to $546.40 million in tokens. The net selling pressure continues to dominate the spot market.

On the technical side, WLFI trades just under the VWAP line near $0.23 on spot charts. A decisive move above this level would align technical momentum with derivatives positioning.

The proposal includes some uncertainties, such as actual fee amounts, making it difficult to estimate the burn impact. There was also no contingency plan mentioned for emergency treasury funds after committing fees to burning.

The post World Liberty Financial (WLFI) Price: Short Squeeze Setup Brewing Despite Market Weakness appeared first on CoinCentral.

5 days ago

1

5 days ago

1

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·