Yet among them, XRP has carved out a truly distinct identity. Unlike Bitcoin’s store-of-value role or Ethereum’s expansive smart contract ecosystem, XRP was engineered from the ground up with a very specific mission: to make global payments faster, cheaper, and more efficient.

This focus has allowed XRP to gain adoption not only among retail traders but also within the financial services industry. Banks, remittance companies, and payment providers have tested or integrated XRP’s technology for real-world settlement. This is considered a rare distinction in a space where speculation often outweighs utility.

While the broader crypto market has been shaped by narratives like decentralized finance (DeFi), non-fungible tokens (NFTs), and meme culture, XRP has consistently remained centered on a practical use case: streamlining cross-border payments.

At the same time, XRP’s technological design sets it apart. It was not mined into existence like Bitcoin or Ethereum, nor does it rely on resource-heavy proof-of-work systems. Instead, it was fully pre-mined at launch and operates on an environmentally friendly consensus model that requires no mining rigs or vast electricity consumption.

This makes it both sustainable and predictable, with clear supply management via escrow systems. For investors, institutions, and developers, these attributes combine to position XRP as one of the most intriguing assets in the digital economy. Even amid ongoing debates and legal battles, XRP has maintained relevance, proving that its foundational differences give it durability in a crowded field of crypto competitors.

Pre-mined supply and predictable release

A defining feature of XRP is its pre-mined structure. When the XRP Ledger launched in 2012, 100 billion tokens were created in advance. Unlike Bitcoin, which continues to release new coins through mining until its 21 million cap is reached, XRP’s supply was fixed from day one. Ripple Labs, the company closely associated with XRP, placed much of this supply in escrow accounts to release gradually over time.

This model has both supporters and critics. Advocates argue that the escrow system creates transparency and predictability in circulation, while critics question the centralization of holding such a large share. Regardless, it’s a clear structural difference from the majority of cryptocurrencies, whose issuance relies on mining rewards or staking mechanisms. For institutional players in finance, this degree of supply control may feel more familiar than the uncertainty of mined assets.

Fast and low-cost transactions

Another striking distinction is XRP’s efficiency. Transactions on the XRP Ledger settle in seconds, usually within 3 to 5 seconds, compared with Bitcoin’s 10-minute block time or Ethereum’s minutes-long settlement under congestion. Just as impressive is the cost: often less than a fraction of a cent per transaction.

This speed and affordability are not theoretical. They have been tested in real-world remittance corridors, particularly in regions where sending money across borders is slow and expensive. Ripple’s partnerships with financial institutions in Asia, Europe, and Latin America have shown how XRP can reduce friction in cross-currency transfers, offering near-instant settlement without the high fees of traditional intermediaries. In an industry where scalability and usability matter, XRP’s cost and speed stand out as practical advantages, not just marketing points.

Energy-efficient consensus model

Sustainability is an increasingly pressing concern in the crypto world. Bitcoin, for example, has faced criticism for its massive energy footprint, with mining consuming more electricity than some countries. XRP, by contrast, uses a consensus mechanism that doesn’t require proof-of-work mining.

Instead, trusted validators agree on the order and validity of transactions. This process consumes only a tiny fraction of the energy required by proof-of-work or even some proof-of-stake systems. According to data cited by CME Group, an XRP transaction uses about 0.0079 kWh of electricity, while Bitcoin consumes around 707 kWh per transaction. In an era where environmental, social, and governance (ESG) standards matter for institutional adoption, XRP’s efficiency provides a key differentiator.

Purpose-built for payments, not speculation

Perhaps the most important distinction is XRP’s original purpose. Bitcoin emerged as “digital gold,” designed to operate outside the traditional financial system. Ethereum created a programmable blockchain that could host decentralized applications. XRP, however, was built with a narrower and more targeted focus: facilitating payments between different fiat currencies.

It functions as a bridge asset, allowing banks or payment providers to convert one currency to another quickly. Without requiring pre-funded accounts in multiple jurisdictions, the process becomes faster and cheaper for institutions handling cross-border transactions. For example, rather than holding large sums of yen, pesos, or euros to facilitate transactions, a bank could hold XRP. It can then use it as a liquidity bridge and settle payments globally in real time with minimal cost. This is a major difference from most cryptocurrencies, which either position themselves as speculative investments or as infrastructure for decentralized ecosystems. XRP was designed with enterprise adoption in mind.

Advanced features on the XRP Ledger

The XRP Ledger itself is not just a payments rail, it has built-in functionalities that many blockchains lack at the base layer. It includes a native decentralized exchange (DEX), enabling seamless token swaps without relying on external platforms. Developers can tokenize assets directly on the ledger, create custom tokens, and build additional applications without requiring complex add-ons.

This emphasis on versatility means XRP is not only a currency but also part of a broader programmable ecosystem. While Ethereum and other Layer 1 blockchains remain dominant for dApps and smart contracts, XRP’s ledger offers a cleaner, more efficient environment for financial-focused applications.

Proven reliability and long track record

Since 2012, the XRP Ledger has maintained more than a decade of continuous, secure operation. Few blockchain projects can claim such reliability. With thousands of days of error-free performance, it has weathered the storms of crypto booms, crashes, and regulatory challenges. For enterprises considering blockchain technology, this reliability matters as much as innovation.

Developers also benefit from clear documentation and tools provided through XRPL.org, making it easier to integrate payment solutions or build custom features. Stability combined with developer resources has helped XRP maintain relevance even as newer, more experimental chains emerged.

Market behavior and independence

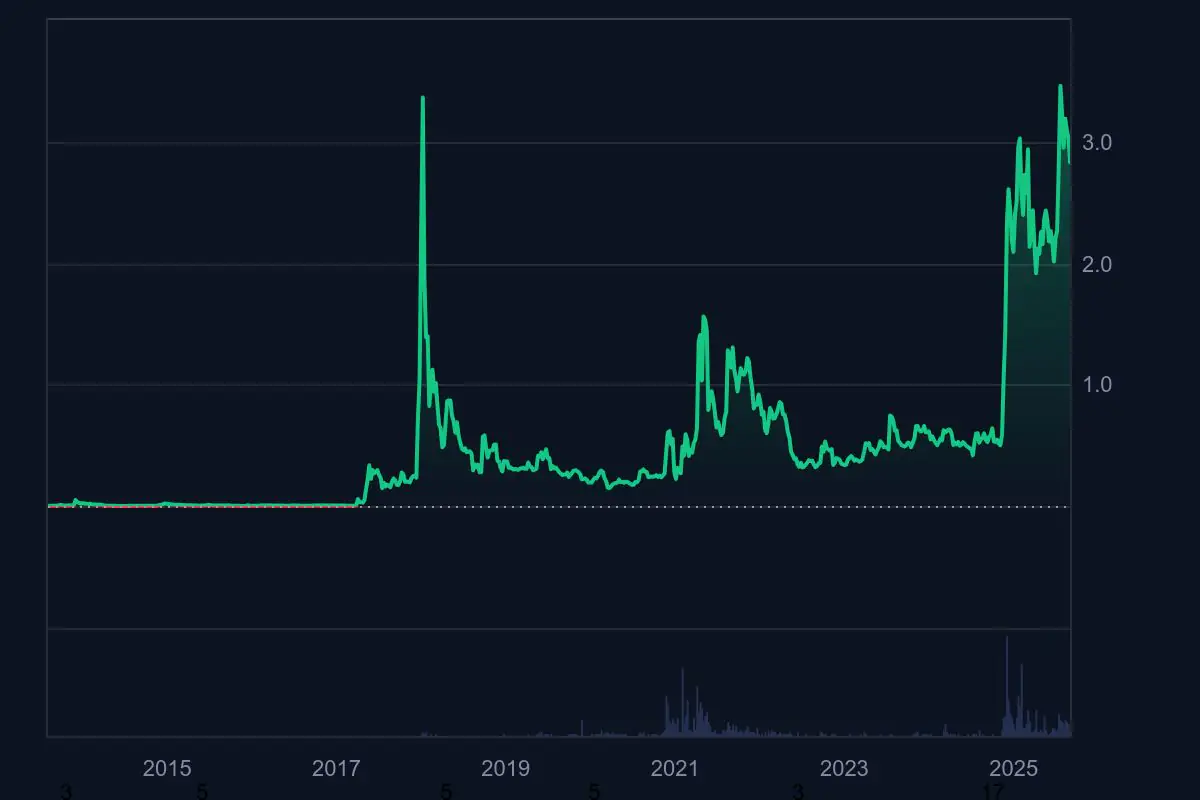

Another subtle but important difference lies in XRP’s market correlations. Studies from CME Group highlight that XRP’s price correlation with Bitcoin or Ethereum is weaker than that of many other top assets. While Bitcoin and Ethereum often move in lockstep (+0.8 correlation), XRP tends to hover between +0.4 and +0.6.

This relative independence suggests that XRP’s price action may be influenced more by payment-related adoption and regulatory milestones than by speculative flows tied to broader crypto narratives. For investors seeking diversification within digital assets, this makes XRP an unusual case.

Regulatory clarity and Ripple’s influence

XRP’s journey has also been shaped by regulatory battles, particularly the U.S. Securities and Exchange Commission lawsuit alleging that Ripple Labs conducted unregistered securities offerings. In 2023 and 2024, courts ruled that XRP itself is not a security, providing a level of clarity rare in the crypto world.

Ripple Labs, though technically separate from the XRP Ledger, remains a key player in driving partnerships and promoting institutional adoption. With licenses in jurisdictions like Singapore and Europe, Ripple’s role adds a corporate layer of legitimacy to XRP’s technological foundation. Few other cryptocurrencies have both a decentralized ledger and a large corporate advocate pushing for global adoption.

Conclusion

XRP is different because it was built with a purpose—to make money move like information: fast, cheap, and borderless. Its pre-mined and escrow-controlled supply, lightning-fast settlement, ultra-low costs, and energy efficiency make it stand out. Beyond technology, its focus on financial institutions, its built-in DEX, and its proven track record give it credibility that most cryptocurrencies can’t match.

For investors and institutions alike, XRP represents more than just another speculative coin. It is a utility-driven digital asset with a clearly defined role in the evolving global financial system. And in a crowded crypto market, that clarity of purpose is what truly makes XRP different from every other cryptocurrency.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post What Makes XRP Different From Every Other Cryptocurrency appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·