In a notable development within the intersection of traditional finance and blockchain technology, SharpLink Gaming — one of the largest public holders of Ether — has announced its plans to tokenize its common stock on the Ethereum blockchain. This move reflects a broader trend of corporations embracing blockchain for innovative capital markets solutions, aiming to enhance liquidity, transparency, and compliance in securities trading.

SharpLink Gaming, a prominent player in the performance marketing sector specializing in iGaming and sports betting, revealed plans to tokenize its common stock via the Ethereum blockchain. Partnering with the fintech firm Superstate, the company will leverage its Open Bell platform to convert its Nasdaq-listed shares (SBET) into digital tokens. This step signifies a technological milestone and a strategic move towards modernizing capital markets.

“Tokenizing SharpLink’s equity directly on Ethereum embodies not just a technological breakthrough but also signals our vision of where global capital markets are headed,” said co-CEO Joseph Chalom.

By partnering with Superstate, SharpLink joins an emerging cohort of companies opting for public stock tokenization. For example, Forward Industries recently announced its move to tokenize shares on the Solana blockchain, further validating the industry’s shift towards blockchain-enabled equity trading.

Second-largest ETH holder

Founded in 2019, SharpLink initially focused on marketing services within the iGaming and sports betting sectors. In June 2025, the company pivoted to creating a corporate Ether reserve, emerging as one of the world’s top public ETH holdings. This strategic reserve showcases a growing trend among public companies leveraging cryptocurrencies as part of their treasury strategies.

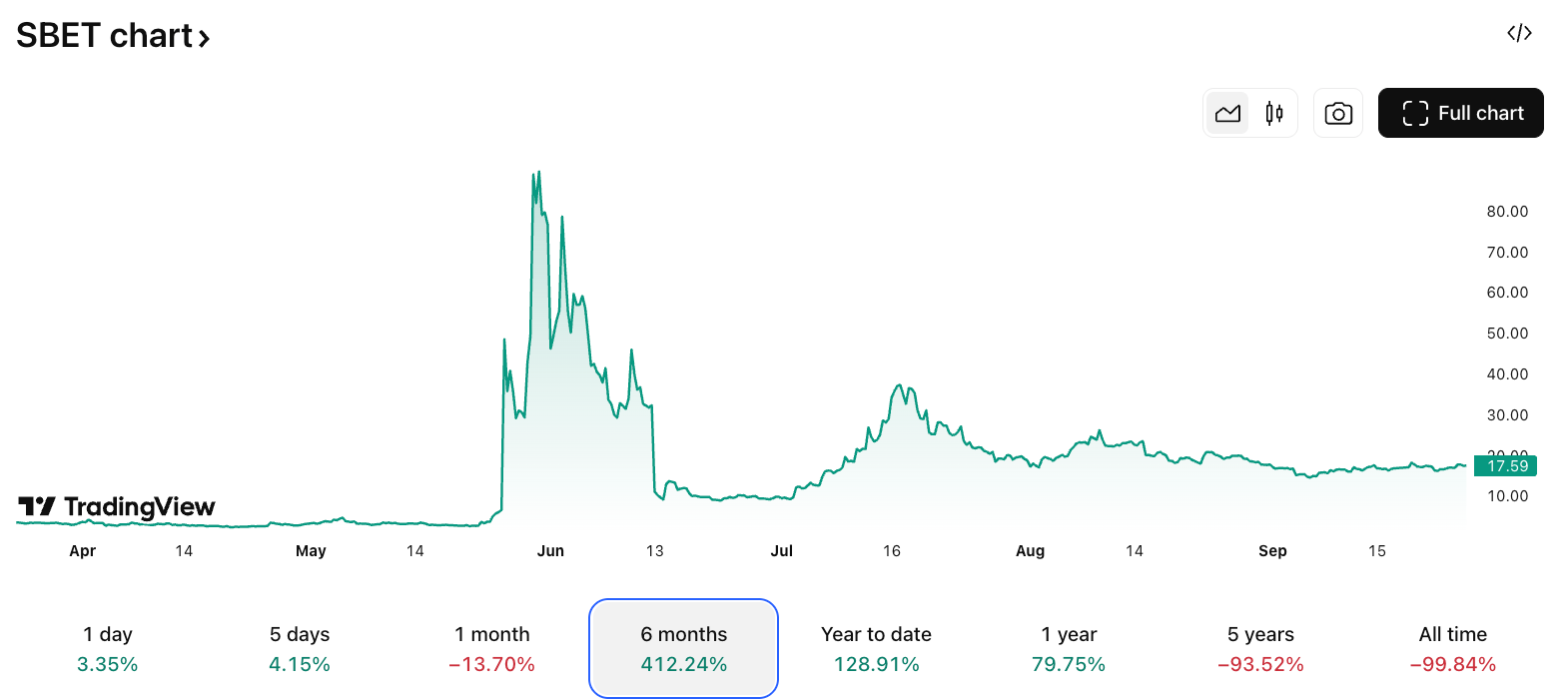

SharpLink Gaming is the second-largest public company holding Ether as of Sept. 25. Source: CoinGeckoFollowing the announcement of its ETH treasury, SharpLink’s shares surged over 100%, jumping from approximately $40 on May 27 to nearly $90 on May 30. However, the stock subsequently declined sharply, falling below $40 by mid-June and stabilizing around that level since. This volatility underscores the experimental nature of integrating cryptocurrencies with traditional equity markets.

Sharplink Gaming (SBET) stock six-month price chart. Source: TradingView

Sharplink Gaming (SBET) stock six-month price chart. Source: TradingView

Expanding trading through DeFi

According to a filing with the U.S. Securities and Exchange Commission, Sharplink intends to develop mechanisms for trading its tokenized shares on decentralized exchanges, particularly automated market makers (AMMs). These protocols leverage smart contracts and liquidity pools, enabling seamless trading of digital assets without traditional market intermediaries.

Moreover, the company aims to expand these efforts across other decentralized finance (DeFi) protocols in a fully compliant manner. This initiative complements regulatory advancements and aims to modernize securities trading, aligning with the SEC’s broader objectives to foster innovation while safeguarding investor interests.

“This initiative aligns with the SEC’s Project Crypto agenda, aimed at integrating digital assets into the regulatory framework and supporting on-chain markets,” stated Sharplink.

Further reading: 7 reasons why Bitcoin mining is a terrible business idea

This article was originally published as Tokenize SBET Common Stock on Ethereum with SharpLink’s Platform on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

1 hour ago

4

1 hour ago

4

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·