By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI FounderI often get requests to write posts about political issues. I generally decline to do so. It's not because I don't find politics interesting. I do. I decline them for business reasons. I am well aware that The White Coat Investor community is composed of people with all kinds of political views and that any political stance I take or defend is likely to be opposed by half of our community. Why anger half of our potential customers? I want docs and other high-income professionals to stop doing dumb stuff with their money, no matter where they find themselves on the political spectrum.

If you're curious about my politics, know that in the last seven presidential elections, I've voted for three Republicans, one Democrat, and three third-party candidates. That is typically how most of my ballots look, too. I thought I was a conservative when I lived in purplish Virginia. After moving to bright red Utah, I feel more like a liberal. Like most Utahns, I registered as a Republican so I can vote in the only election that matters here—the primary election. I generally find myself voting for the most moderate Republican candidate in the primary.

Now that I've alienated 90%+ of WCIers, let's get into some political topics. One comes from a recent email, and the other comes from a WCI Forum post I responded to recently.

“Blog post ideas:

“How worried about the national debt should you be?” “How to invest with rising national debt in mind” “What can you do to protect yourself today for a debt crisis tomorrow?” “How you can hedge against rising national debt?”Just some ideas, take em or leave em!”

And

“Some of you might laugh at this, but I see the writing on the wall. Even if WW3 doesn't happen, I know being a brown, naturalized citizen, I am most likely going to have to leave soon. And I will be heading to Canada. I have ‘substantial to me' funds in Fidelity invested in a three-fund portfolio. About 80% is a 401(k) and 20% in Roth. I also have investments in TSP. I will be selling my house in preparation for departure, but I have also been considering liquidating all my retirement accounts, paying penalties and tax, and moving them to the Canadian investment banks. What are the implications of this? I still have about 20 years left in the job market, but given the poor prospects for employment in Canada, I need to protect whatever nest egg I currently have in case I can't make a reasonable salary there. Am I completely nuts? How would you protect your wealth from a rogue state and the end game of Project 2025.”

Politics and Your Portfolio

Plenty of people have strongly held political views. I'm obviously not one of them. Maybe it is my relatively moderate political beliefs. More likely, it's because, “I've seen this movie before and I know how it ends.” I can find something I like AND something I don't like that every Congress and every president has done. I've watched people (from both ends of the political spectrum) threaten to leave the country (or hole up in a bunker) after a presidential election doesn't go their way. Somehow, we still manage to muddle through.

I think a big part of it is that people didn't pay a lot of attention in their high school civics class. The founders of the United States had their problems, but there is great wisdom in their implementation of a separation of powers. Even with an administration, like the current one, trying to maximize its power over Congress, the courts, and the Fed, those institutions still have substantial power. Plus, only so much damage (or good, depending on your perspective) can be done in four years before the next presidential election (or two before the next congressional election).

More information here:

Confiscation Due to Political Calamity

Reactionary Portfolio Moves Usually Cost Money

As a general rule, making portfolio changes in response to anything in the financial or political news is a mistake. Jack Bogle famously said,

“I've said ‘Stay the course' a thousand times, and I meant it every time. It is the most important single piece of investment wisdom I can give to you.”

I am a big advocate of using a periodically rebalanced, static asset allocation composed primarily of low-cost, broadly diversified index funds. Static. That means it doesn't change. It doesn't change because stocks go down. It doesn't change because the House of Representatives flips. It doesn't change because PPACA or TCJA or OBBBA passes. It doesn't change because interest rates went up. It doesn't change because there is war in Ukraine or Israel or Afghanistan or Vietnam. Static. The idea behind setting it up was to have a portfolio that would be likely to help us reach all of our financial goals, even if various reasonably likely political and economic risks show up. Whatever political or economic change you currently feel like reacting to, that risk is not new. It has always been a possibility. Like falling 35 feet on the North Face of the Grand Teton due to loose rock. I'd been running that risk for decades; it just finally showed up on August 21, 2024. That's why I always climbed with a rope, a helmet, and a very competent partner.

Those who make reactionary portfolio moves usually come out behind. They end up buying high and/or selling low. Before you do anything major with your portfolio, consider the alternative of doing nothing. I didn't do anything when President Biden was elected. I didn't do anything when President Trump was elected either time. Doing nothing paid off all three times.

Thoughts on Canada

All that said, I think moving to Canada is a fabulous idea. I love Canada, especially British Columbia. Every trip I've ever had to BC has been spectacular, and I seriously considered trying to get a job in Squamish two decades ago. We even went into the ER to try to talk to someone about it. There are lots of wonderful things about Canada. If you want to go to Canada, I am highly supportive. But don't do it just because of political concerns. You'll likely regret it. Especially if the move involves pulling all of the money out of your retirement accounts and paying taxes and penalties. Just the moving costs should be enough to dissuade most people.

Thanks to tax treaties, tax-deferred US retirement account money remains tax-deferred in both the US and the Canadian system until you pull out the money, even if you renounce your US citizenship and establish Canadian citizenship. It takes serious paranoia to pay all of those costs just to move money to Canadian investment institutions. Roth accounts are treated slightly differently, but earnings after your move to Canada can still be tax-deferred. Tax-deferred accounts can be transferred to Canadian equivalents, too. More details for those serious about moving to Canada can be found in this excellent article.

More information here:

How Moving to Canada Affected My Life as a Physician

Navigating the Minefield of Foreign Investing as a US Expat

Thoughts on World War III

Lots of investors worry about the effect that World War III would have on their investments. They're right to worry. Devastation is one of the four “deep risks” Bill Bernstein describes as true portfolio risk (the others are inflation, deflation, and confiscation). Given that numerous countries now have access to nuclear weapons, World War III is likely to be even more apocalyptic than the effects of World War II in Europe and Japan.

What should one do with their portfolio if they think World War III is likely to occur within the next few years? Probably act as if it isn't likely to occur. If it doesn't occur, you'll be glad you didn't do anything outlandish. And if it does occur, we're all in an equally bad place. Guns, ammo, food storage, and other “prepper” type purchases seem far more useful than just beefing up an allocation to precious metals, cryptoassets, or emerging market bonds. That said, putting a little bit of money into precious metals, cryptoassets, or defense stocks doesn't seem nuts.

Thoughts on the US Debt

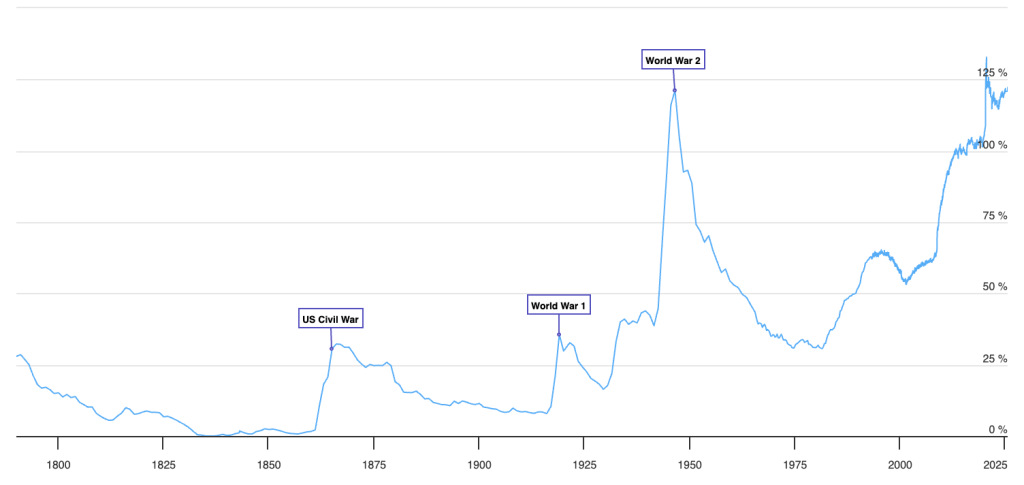

We have had a US debt since, well, Alexander Hamilton famously advocated for it in a Broadway play. Many economists worry that it may become too large. Clearly, having a little bit of US debt is probably fine, and it allows us all to invest in those sweet Treasury bonds. The question is, “How much is too much US debt?” Of course, the answer is not an absolute amount. It is related both to the size of the US economy and interest rates. The smaller the economy and the higher the interest rates, the less US debt is OK. There is a statistic out there that suggests a debt-to-GDP ratio of more than 90% slows economic growth (and ours is currently at 123%), but that doesn't necessarily spell doom. We've been to a similar ratio before, after World War II.

There are basically five methods for improving this ratio:

Spend less Raise taxes Inflate the debt away Grow the economy DefaultObviously, one of these is way better than the other four, and the big issue with the four “bad” methods is that they tend to have a deleterious effect on the “good” one. So, is our debt level too high? Nobody really knows, and it really comes down to future economic growth—which is equally unknowable.

More information here:

Staying the Course Despite the Trump Tariffs

Trump Will Allow You to Make Dangerous Moves in Your 401(k), Including Adding Crypto

Optimists Are the Best Investors, Even If the Pessimists Sound Smarter

What to Invest in If You're Worried About the National Debt?

So, what should you invest in if you're really, really worried about the current level of the US debt? There are plenty of options to consider, each with pluses and minuses.

Foreign Stocks, Real Estate, and Currencies

This method works particularly well if the debt problem is limited only to your country. But since economies are more and more intertwined as time goes on, this is likely only part of your solution. Nonetheless, it is something we have been doing with our portfolio for decades. One-third of our stocks are foreign, and they always have been, just in case this risk ever showed up.

TIPS and I Bonds

Inflation-indexed bonds work far better than nominal bonds if inflation rears its ugly head. They won't help much in a default scenario, though. And if real interest rates rise due to fear of default or inflation, that will decrease the value of a TIPS portfolio like it did in 2022. Nevertheless, we index half of our bond portfolio to inflation as this is the most common, serious risk for bonds.

Precious Metals

Gold and similar precious metals tend to track inflation long term, although swings can be pretty dramatic in the short term. If you have a serious fear of default or inflation, it would not be bonkers to put a small slice of your money into precious metals.

Cryptoassets

Bitcoin gets favorable tax treatment, and it is also mostly independent of the US government. That doesn't mean it will zig when the US zags (it seems to be pretty correlated with other risky assets at times), but it might be worth a try with a small percentage of your portfolio.

Real Estate

The government can't default on your real estate, and it will probably keep up with inflation. It also tends to have good returns in good times. This is one reason we've placed 20% of our portfolio into real estate.

Debt

One of the best “assets” to own in inflationary times is low fixed interest rate debt. OK, maybe it isn't an asset, but it certainly benefits from high inflation, unlike those who loaned the money. And if the world blows up, at least you probably won't have to pay back your debts.

Commodities

Theoretically, commodities do well in inflationary times. No guarantee, though. The price of oil spiked in 2022, but by the end of the year, it was back where it started.

Guns, Ammo, and Food Storage

These are always helpful if things get really bad.

Basically, anything that isn't the “classic” portfolio of large cap US stocks and US Treasuries will probably do a little better in a “US debt crisis.”

But don't let your political views and your anxiety get the best of you. Invest dispassionately, consistently, and intelligently, and you're highly likely to reach your goals. Unless there is a zombie apocalypse. Then you're going to have to get really creative.

What do you think? How much should your political views and fears affect your portfolio? Do you have any “hedges” in your portfolio due to worries like these?

The post The National Debt and World War III — How Should Politics Affect Your Investing Strategy? appeared first on The White Coat Investor - Investing & Personal Finance for Doctors.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·