With whale activity steady and technical charts pointing to mixed signals, holders are weighing whether the crypto can build enough momentum for a breakout. The conversation now centers on price targets, support zones, and the possibility of a rebound that could alter its near-term outlook.

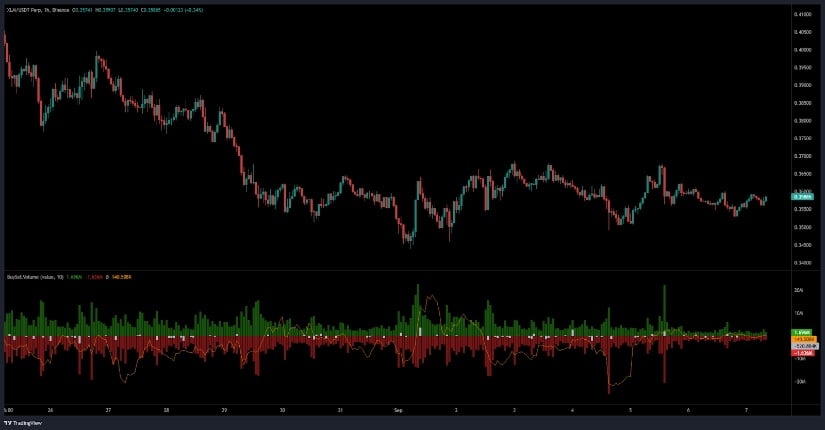

Open Interest and Market Liquidity

Recent data from Open Interest highlights XLM/USDT perpetual contracts, focusing on buy and sell volumes. Price recently stabilized around $0.36 after a period of downward pressure, reflecting attempts by buyers to absorb selling interest.

Open interest levels show alternating bursts of green and red, suggesting that the market remains divided between bullish accumulation and profit-taking. This balance has kept the token locked within a tight range, awaiting a stronger directional push.

Source: Open interest

Such volume behavior often signals a buildup phase where large players position themselves before a breakout. The ability of bulls to defend the $0.35–$0.36 region will determine whether the coin can pivot higher. Traders see this zone as the foundation for the next leg, with liquidity flows hinting that momentum could shift quickly once conviction returns.

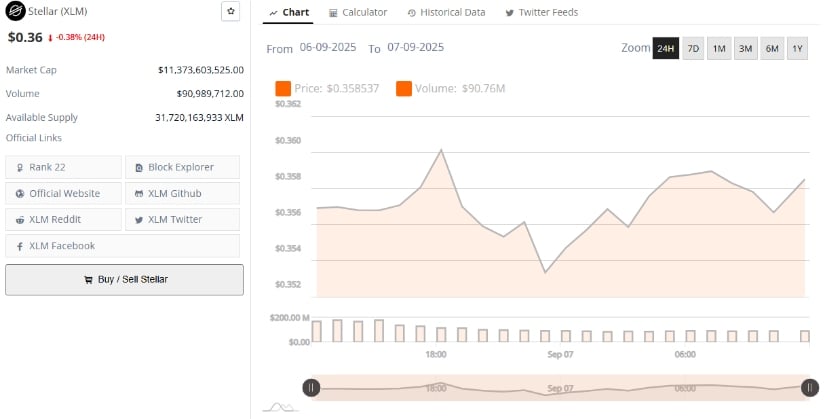

Stellar Maintains $0.36 Amid Consistent Trading Activity

According to BraveNewCoin, the token is currently trading at $0.36, reflecting a 24-hour dip of just 0.38%. The token holds a market capitalization of $11.37 billion, supported by a daily trading volume of approximately $90.9 million. With an available supply of 31.7 tokens, Stellar maintains a solid position among major digital assets, ranked 22 globally by market size.

Source: BraveNewCoin

The 24-hour chart shows modest fluctuations, with prices oscillating between $0.354 and $0.362. Despite brief dips, the token recovered toward the $0.36 mark, demonstrating resilience in the face of market uncertainty. This pattern indicates consistent demand from buyers looking to defend key levels, helping maintain stability even as trading volume remained relatively moderate.

Market observers note that the ability to hold near-term support while defending rank and capitalization reflects underlying confidence. Such resilience has kept the cryptocurrency in contention for renewed momentum, with potential targets set around $0.38 and higher if market conditions improve.

Technical Indicators Point to Bearish Pressure

On the other hand, the daily chart from TradingView provides a closer look at Stellar’s current technical structure. At the time of writing, the coin trades at $0.3579, just under its 24-hour peak of $0.3595. Indicators highlight bearish undertones, with the RSI reading at 41.02, below the neutral 50 threshold. This level suggests that sellers remain in control, though the asset has not yet entered oversold conditions.

Source: TradingView

The MACD adds further confirmation, with the MACD line below the signal line and the histogram negative. This alignment reinforces the presence of downward momentum, with the market likely to test support levels again before a clear reversal emerges. However, traders note that extended compression at these levels often precedes sharp rebounds if buyers regain initiative.

For now, the $0.35 support zone remains the line in the sand for the asset holders. A sustained hold above this threshold could open the door toward $0.38 and eventually $0.40, while failure to defend it risks deeper pullbacks. The market remains watchful, with the crypto’s next move set to define whether a rally toward $0.50 can still come back into focus.

3 hours ago

4

3 hours ago

4

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·