Market watchers now believe Solana could be gearing up for its biggest breakout of the year, with the token reclaiming the $220 mark for the first time in months. The move comes after a wave of short liquidations worth over $17M, giving bulls fresh momentum to push higher.

Solana Clears $220 With Short Liquidations Fueling the Rally

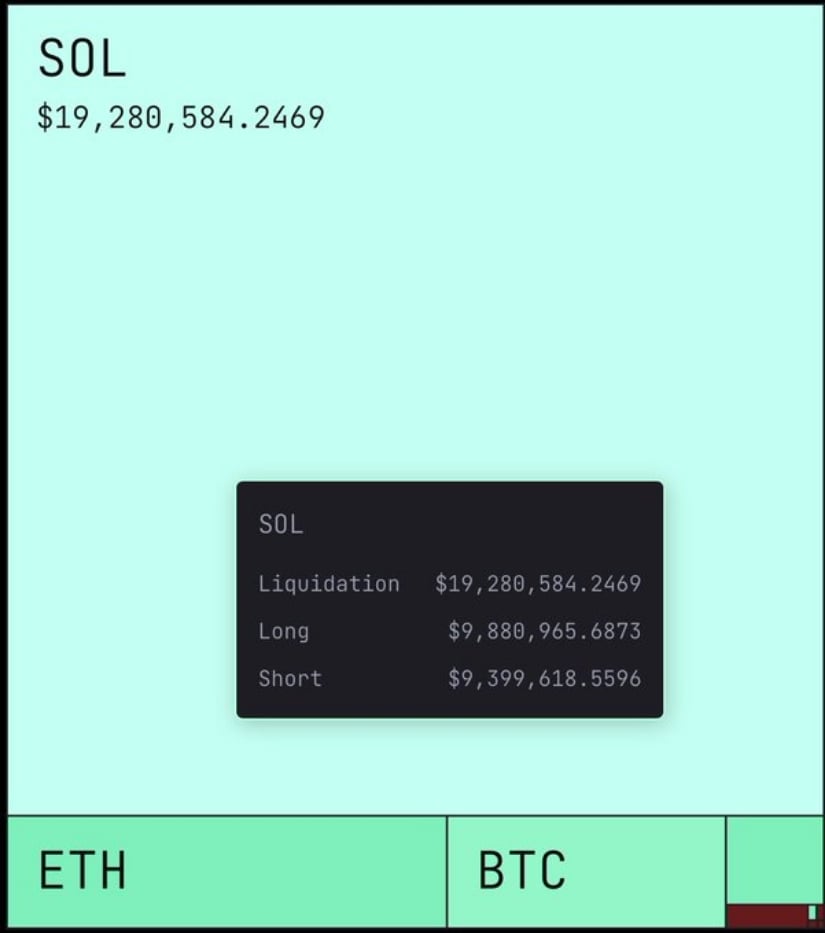

Solana just delivered a major move, breaking above the $220 mark for the first time in eight months and triggering over $17M in short liquidations. The squeeze reflects how positioning had been leaning against SOL, but the breakout forced sellers to cover, adding fuel to the momentum.

Solana surges past $220 for the first time in eight months, fueled by over $17M in short liquidations. Source: SolanaFloor via X

On-chain perpetuals continue to lead centralized exchanges in liquidations, highlighting how much activity is being driven natively on Solana.

From SolanaFloor’s angle, clearing $220 resets the structure and puts bulls back in control. If price holds this level as support, the next upside targets sit around $238 and $250, levels that previously acted as key supply zones. With liquidity flushing out shorts and on-chain strength backing the move, Solana carries a setup that could extend the rally further into September.

Solana Eyes $300 as Momentum Builds

Solana’s latest push higher has reinforced the strength of its bullish trend, with Sheldon_Sniper now pointing towards $300 as the next major milestone. After clearing the $220 barrier and absorbing heavy short liquidations, SOL has established a stronger base of support, giving bulls confidence to press forward.

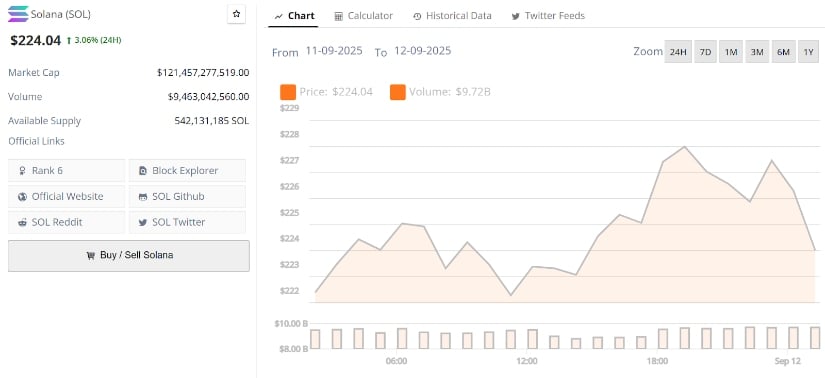

Solana is trading at around $224.04, up 3.06% in the last 24 hours. Source: Brave New Coin

Technically, the chart highlights a series of higher lows leading into the breakout, a pattern that often precedes sustained upside. If SOL continues to defend the $220 to $225 zone, the next resistance band sits around $250 before opening the path toward $280 to $300.

SOL Solana Technical Outlook

Solana has reclaimed the $216 level, turning a key resistance back into support, which now sets the stage for its next upside push. The price action is showing clear follow-through, with SOL eyeing $238 as the immediate resistance to test. This zone has previously acted as a supply cap, so a clean break above it could open the door for Solana to retest its prior highs. Structurally, the chart highlights a strong series of higher lows, suggesting that buyers remain firmly in control of the trend.

Solana reclaims $216 as support and now targets $238 resistance, with bulls eyeing a potential run towards prior highs. Source: Lennart Snyder via X

Analyst Lennart Snyder points out that any short-term pullbacks into the $216 area could provide a textbook resistance-turned-support flip, strengthening the base for the next leg higher. Above $238, the final hurdle left on the chart is the all-time high zone, meaning Solana is entering a critical stretch where momentum and volume will be decisive. If bulls defend the reclaimed levels effectively, SOL could soon find itself pressing into uncharted territory once again.

SOL’s Uptrend Backed by Institutional Buys

New data reveals that Galaxy Digital has been aggressively accumulating Solana, acquiring 430,000 SOL worth $97 million in just one hour and totaling 1.35 million SOL ($302 million) over the last 12 hours. This scale of buying could possibly be one of the reasons fueling SOL’s ongoing price appreciation.

Galaxy Digital scoops up 1.35M SOL worth $302M in just 12 hours, fueling Solana’s bullish momentum. Source: SolanaFloor via X

This wave of institutional accumulation is becoming a critical driver behind Solana’s ongoing upward trend. While retail flows have added momentum, it’s the consistent large-scale purchases like these that reinforce bullish structures and create strong demand. Combined with the recent technical breakout above $220, this type of buying adds fuel to the rally.

Solana Price Prediction: $400 Target in Sight

Solana continues to show remarkable strength, with price holding above $220 and pressing into higher ranges on the weekly chart. The structure highlights a clean breakout from its multi-month consolidation zone, with the 100-day moving average trending positively underneath to reinforce bullish momentum. The chart also suggests that if SOL sustains above $225, the next major checkpoints line up at $250 and $280, levels that could act as interim resistances before the larger move unfolds.

Solana holds firmly above $220 as analyst highlight $400 as the next major long-term target. Source: iWantCoinNews via X

Analyst iWantCoinNews points directly to $400 as the broader target, drawing on the long-term pattern. The weekly setup shows price building a strong base since early 2024, which now appears to be transitioning into a trending phase.

If price maintains momentum and defends its reclaimed support zones, the conditions are aligning for a rally that could extend Solana Price Prediction into the $350 to $400 range.

Final Thoughts

Despite the bullish run, what’s standing out most in Solana’s case is the scale of institutional buying behind it. Galaxy Digital grabbing hundreds of millions worth of SOL in hours has changed the way people are looking at this rally. It’s no longer just another breakout on the chart, it’s big money making a statement, and that adds a different kind of confidence to the move.

The $238 to $250 zone is the real battlefield, and how Solana reacts there decides if $300 comes into play or not. If bulls can turn that into solid support, the push towards $350 to $400 is likely to open up.

2 hours ago

6

2 hours ago

6

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·