Key Points

Borrowers must weigh the benefits of private refinancing against the loss of federal protections like income-driven repayment and loan forgiveness.

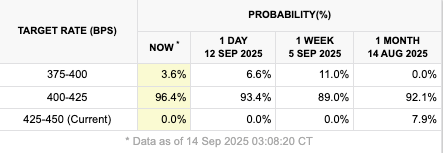

The Federal Reserve is likely to cut interest rates this week, marking a shift after years of aggressive hikes. The CME FedWatch Tool is currently signaling a 100% probability of a Fed rate cut.

For borrowers, particularly those with private student loans, lower rates could make refinancing more attractive. Refinancing allows borrowers to replace existing loans with a new loan, ideally at a lower interest rate.

Consider a borrower with $50,000 in loans at an average rate of 6.5%. Refinancing to 4.5% would reduce both monthly payments and the total interest owed over the life of the loan. The impact can be substantial for those with large balances.

However, the decision isn’t straightforward. For federal loan borrowers, refinancing with a private lender means permanently giving up access to federal programs like income-driven repayment, Public Service Loan Forgiveness, and hardship options such as deferment. That tradeoff can outweigh the savings from lower rates for many.

Would you like to save this?

When Refinancing Makes Sense

Borrowers with high interest rate private loans should always be looking for refinancing opportunities, especially if they can qualify for a fixed rate that is better than their current loan. Even a one-point reduction in rate can lead to thousands in savings over time.

It's important to note that private education loans don't charge origination fees, and they don't have prepayment penalties. That means that you can get a new loan at anytime with no additional costs.

If you currently have a $50,000 loan at 9% interest, your monthly payment is likely around $633 per month for a 10 year term. If you can drop that rate to 6%, you lower your payment to $555 per month.

You'll also pay significantly less over the life of the loan as a result.

The only way to know if you can save on interest is to shop and compare at least 3-5 student loan refinance lenders.

Who Should Not Refinance Their Student Loans

Federal student loan holders face a tougher choice. Those who are confident they won’t need income-driven repayment or forgiveness programs might see refinancing as a way to cut costs. But for the majority, keeping federal protections could be more valuable than shaving a few percentage points off interest.

A rule of thumb: borrowers in stable, high-income professions with no plans to rely on federal programs may benefit most from refinancing. Others should think carefully before giving up flexible repayment options.

When you refinance your federal loan, you now have a private loan. That means you'll no longer be eligible for income-driven repayment plans, student loan forgiveness programs, and more.

The Bottom Line

Borrowers thinking about refinancing their student loans should take a few key steps:

Check your credit: Lenders offer their best rates for those with strong credit scores and low debt-to-income ratios.Compare multiple offers (at least 3-5): Rates and terms vary widely, so shop around with different lenders.Decide on fixed vs. variable rates: A fixed rate provides certainty, while a variable rate could be cheaper initially but carry risk if rates climb again.Weigh federal benefits: For federal loan holders, the loss of protections must be part of the calculation.For many, refinancing is less about chasing the absolute lowest rate and more about finding balance between immediate savings and long-term flexibility. The lowest rates will always go to shorter-term loans.

The potential for falling interest rates has created new opportunities for student loan borrowers. But refinancing is not a one-size-fits-all solution. The benefits are clear for those with private loans or for borrowers certain they won’t rely on federal programs.

For others, the security and protections of federal loans may outweigh any savings.

Don't Miss These Other Stories:

Editor: Colin Graves

The post Should You Refinance Student Loans If Rates Fall? appeared first on The College Investor.

2 hours ago

5

2 hours ago

5

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·