Analysts note that the token has consistently posted higher lows since its recovery from the $0.18 range earlier this year, with price action now compressing between converging trendlines.

This structure typically precedes expansion, suggesting the token may soon attempt a decisive breakout toward key resistance levels.

Pennant Formation Highlights Accumulation

On the SEI/USDT chart, the pennant is forming just above a solid horizontal support near $0.28, adding strength to the bullish setup. The pattern reflects a tightening balance between buyers and sellers, where momentum often shifts in favor of bulls once resistance is breached. Analysts point to this coiling structure as evidence of sustained accumulation by market participants.

Source: X

Historically, the asset has broken multiple descending trendlines in recent months, each time leading to meaningful upward rallies. The current pennant is developing just below the $0.35–$0.40 zone, a resistance band that has capped previous attempts higher. A successful breakout above this area could unlock a move toward $0.50, with an extended target potentially stretching to $0.65.

Market Data Confirms Steady Demand

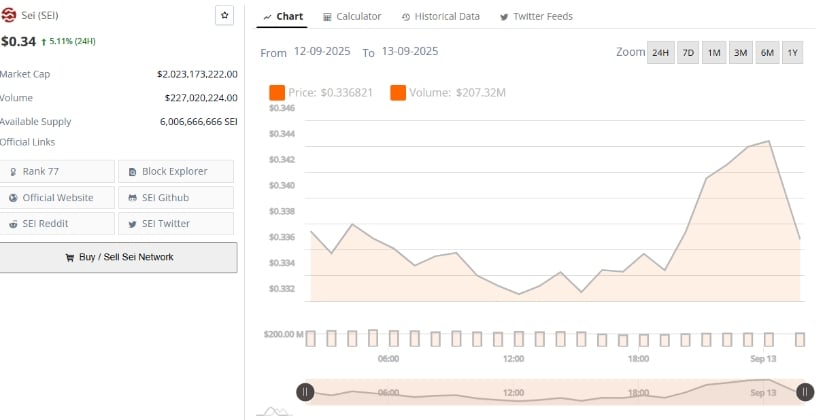

At press time, SEI trades at $0.34, up 5.11% over the past 24 hours, according to BraveNewCoin. This uptick reflects growing momentum as buyers accumulate in the $0.33–$0.34 range, where intraday support has formed. Despite broader crypto market volatility, the token has managed to stabilize, strengthening the bullish case built around its pennant pattern.

Source: BraveNewCoin

The project’s market capitalization of $2.02 billion places the asset among the top 80 cryptocurrencies, with an available supply of over 6 billion tokens in circulation. Its 24-hour trading volume of $227 million signals strong participation, providing the liquidity needed for further price expansion if bullish sentiment continues to hold.

Short-term trading data show the memecoin fluctuating within a narrow $0.332–$0.344 range, often a precursor to stronger directional moves. The gradual rise in volume suggests ongoing accumulation, with traders positioning for a breakout toward the $0.40 resistance. On the downside, maintaining a price above $0.33 is critical to avoid a retest of the $0.30 support.

Indicators Support Upward Momentum

On the other hand, the latest TradingView analysis highlights bullish signals in SEI’s price structure. The token trades at $0.3434, up 2.11% intraday, with candlestick formations showing higher highs and higher lows. This pattern suggests growing buying interest as the price approaches resistance near $0.39, a level that may serve as the next major test for bulls.

Source: TradingView

The Chaikin Money Flow (CMF) reads +0.09, confirming capital inflows and accumulation in favor of buyers. This positive reading indicates that the volume flow is tilting bullish, reinforcing confidence that cryptocurrencies’ momentum could be sustained in the short term.

Similarly, the MACD indicator shows a constructive setup. The MACD line (0.0049) sits above the signal line (-0.0016), while the histogram is positive at 0.0065. This crossover often signals a trend’s strength, suggesting that buyers are gaining control. Together, these indicators point toward a continuation of the asset’s upward momentum, with conditions favoring a push toward higher resistance levels.

2 hours ago

5

2 hours ago

5

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·