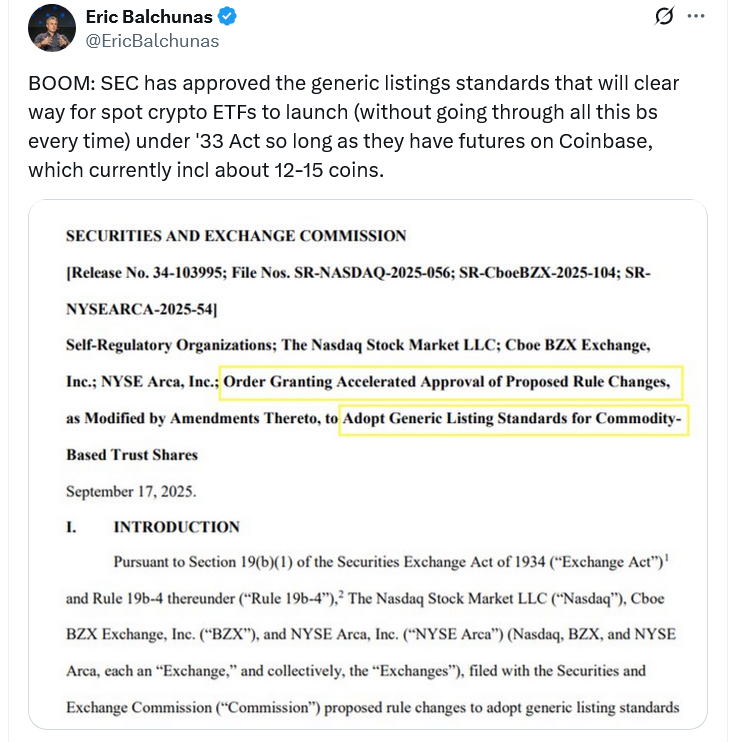

The U.S. Securities and Exchange Commission (SEC) has announced new standards that could significantly expedite the approval process for spot cryptocurrency exchange-traded funds (ETFs). These developments mean that individual applications will no longer require separate, case-by-case assessments, streamlining the pathway for crypto-related investment products.

In a recent filing referencing major stock exchanges like Nasdaq, NYSE Arca, and Cboe BZX, the SEC outlined its move to adopt standardized listing rules under Rule 6c-11. This adjustment aims to reduce approval times that previously stretched over several months, facilitating quicker market entry for innovative digital assets and ETFs tied to cryptocurrencies.

SEC Chair Paul Atkins emphasized the importance of maintaining America’s competitive edge in digital asset innovation. He stated, “By approving these generic listing standards, we are ensuring that our capital markets remain the best place in the world to engage in the cutting-edge innovation of digital assets.”

”This approval helps to maximize investor choice and foster innovation by streamlining the listing process and reducing barriers to access digital asset products within America’s trusted capital markets.”

This regulatory update comes at a pivotal time, as several spot ETF applications for cryptocurrencies like Solana (SOL), XRP, Litecoin (LTC), and Dogecoin (DOGE) await official approval. The SEC also faces upcoming decision deadlines for proposals related to Avalanche (AVAX), Chainlink (LINK), Polkadot (DOT), and Binance Coin (BNB).

Industry experts regard this move as bullish for the crypto markets. Bloomberg ETF analyst James Seyffart remarked, “This is the crypto ETP framework we’ve been waiting for,” anticipating a wave of new investment products launching in the United States shortly.

Source: Eric Balchunas

Source: Eric BalchunasClarifying Standards for Crypto ETF Listings

The SEC has outlined clear criteria for listing spot crypto ETFs. To qualify, a fund must hold a commodity that trades on a market within the Intermarket Surveillance Group offering surveillance-sharing agreements, or it must underlie a futures contract listed on a designated contract market for at least six months with comparable surveillance arrangements. Alternatively, a crypto asset may qualify if it is tracked by an ETF with at least 40% exposure listed on a national securities exchange.

When seeking to list and trade crypto ETFs that fall outside these standards, exchanges are required to submit specific rule filings to the SEC, ensuring transparency and oversight.

Concerns Over Investor Protections

While the move is seen as a positive step for digital assets, SEC Commissioner Caroline Crenshaw raised concerns about potential risks. She warned that the new standards might lead to a flood of unvetted products entering the market, potentially compromising investor protection and market stability.

“The Commission is passing the buck on reviewing these proposals and making the required investor protection findings, in favor of fast tracking these new and arguably unproven products to market.”

As the crypto market continues to evolve, regulatory clarity remains vital for fostering sustainable growth and safeguarding investor interests in the burgeoning blockchain space.

This article was originally published as SEC Approves New Listing Standards for Commodity-Based ETFs on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

1 hour ago

1

1 hour ago

1

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·