Buyers have stepped back in, with whales and retail traders alike defending the mid-$0.70 levels. Market signals are pointing toward renewed momentum, though resistance clusters overhead still need to be cleared. With volume picking up and technical indicators stabilizing, the token is shaping up for a decisive phase in the coming days.

Support Reclaim Brings Traders Back Into Play

On the daily chart, Efloud highlights how OP dipped below its support before quickly reclaiming it, triggering a positive flow that caught traders’ attention. The highlighted support area lies around $0.735–$0.725, a zone that has now become a pivot for momentum. The swift recovery from this dip shows buyers are still willing to defend this level aggressively.

Source: X

The price has since moved upward, climbing back above $0.75–$0.76, where accumulation signals began to build. This rebound has given confidence to traders who were waiting for a retest confirmation before re-entering positions. With the reclaim intact, the blue resistance box near $0.82 comes into play as the next barrier.

If bulls can manage a clear breakout above $0.82, the path opens toward $0.91–$0.92, a level that capped upside moves earlier in the year. Conversely, failure to maintain strength above $0.73 could expose the token back to the lower range near $0.57, making this support critical for trend continuation.

Rising Volumes Highlight Growing Market Interest

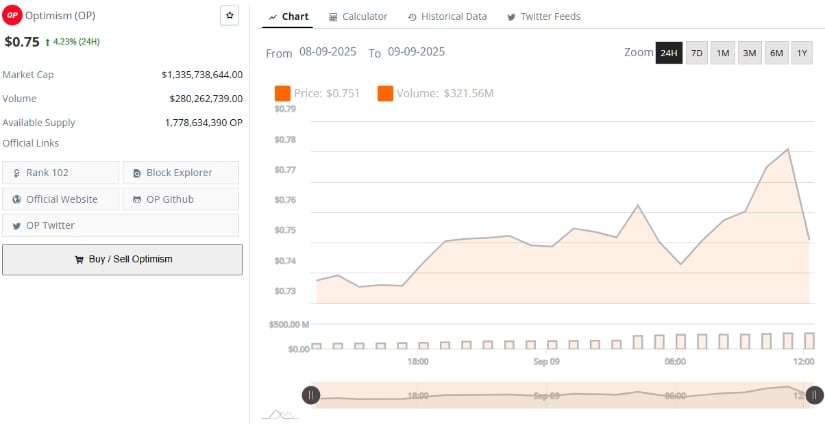

According to market data, OP is trading at $0.75, reflecting a 4.23% gain in the last 24 hours. Daily volume has climbed to $280 million, showing renewed trading activity, while market cap stands at $1.33 billion, placing the crypto at rank 102 among cryptocurrencies. This recovery comes after a volatile week that saw the coin briefly lose the $0.73 handle before bouncing back.

Source: BraveNewCoin

The 24-hour chart shows price attempting multiple pushes above $0.77–$0.79, marking this region as short-term resistance. A strong breakout from here could signal momentum toward $0.82 and beyond, while failure to sustain would reinforce $0.73 as the key support to watch.

Available supply currently stands at 1.77 billion tokens, which means larger price moves require significant volume inflows. The fact that trading activity has spiked suggests the asset is attracting fresh interest, but bulls need to sustain momentum to carry the token higher.

Momentum Builds as Resistance Levels Tighten

On the other hand, the TradingView daily chart adds depth with Bollinger Bands and CMF. OP is currently trading at $0.787, holding above the basis line ($0.7247) and approaching the upper band ($0.7998). This positioning suggests volatility is picking up, with bulls eyeing a potential breakout if the upper band is cleared.

Source: TradingView

The Chaikin Money Flow (CMF) reading is positive at +0.03, reflecting mild capital inflows outweighing outflows. Sustaining CMF above zero is often an early sign of accumulation, meaning traders are quietly buying dips at these levels. If CMF continues to rise, momentum could accelerate.

On the downside, the lower Bollinger Band ($0.6496) marks the most immediate safety net, aligning with consolidation areas from past months. Maintaining a hold above the $0.72–$0.73 base is crucial, while breaking above $0.80 could pave the way for $0.91 and potentially $1.19 in the medium term.

6 hours ago

7

6 hours ago

7

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·