Earlier this cycle, when ETH dipped below $1,500, critics were quick to proclaim the “death” of Ethereum. But the latest figures from Alphractal and Joao Wedson tell a very different story.

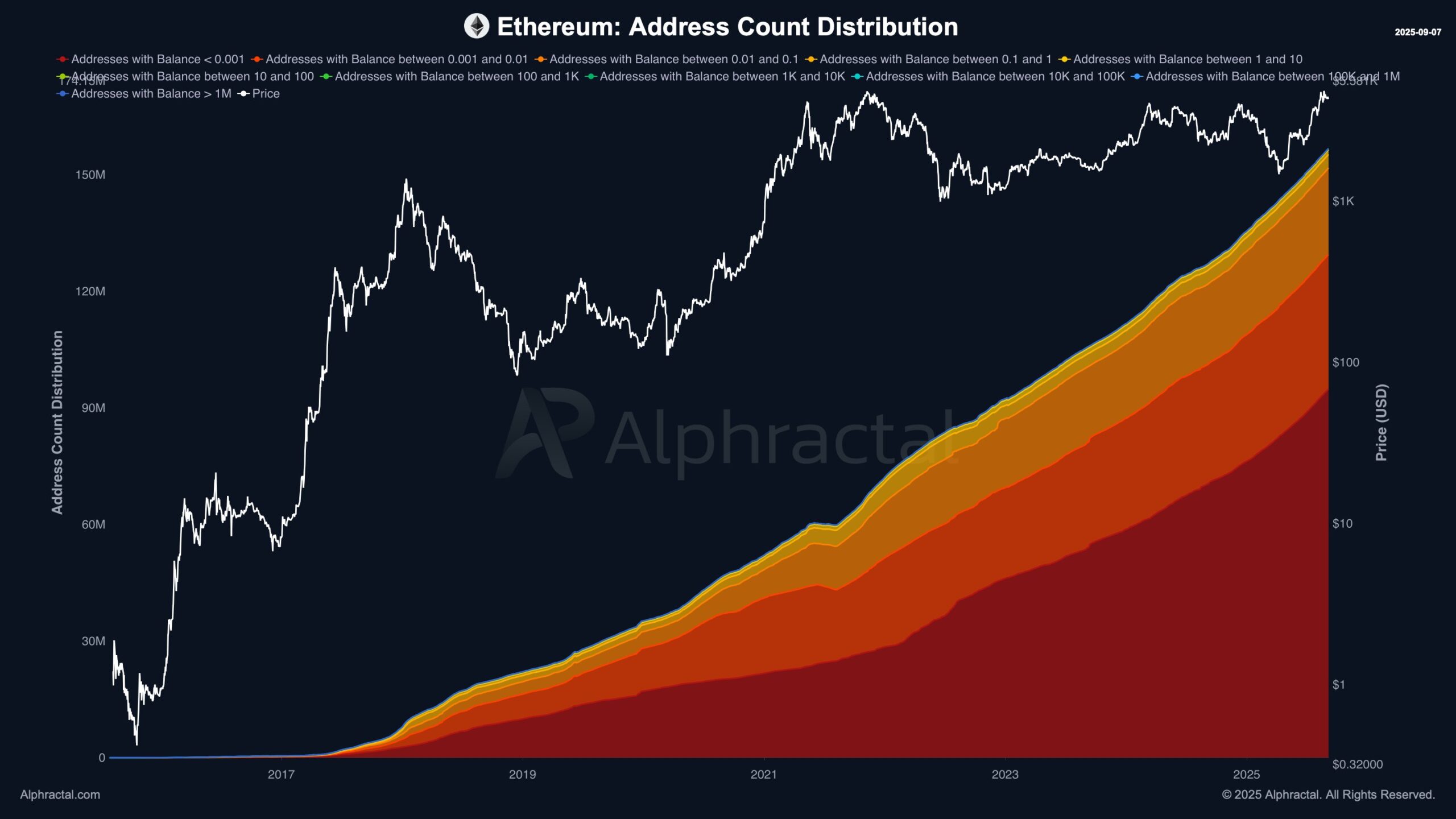

Across every balance tier, the number of Ethereum addresses has been trending upward, showing that the network is not only alive but steadily expanding.

This growth is fueled by a combination of speculators chasing upside, developers building applications, and long-term investors who continue to view Ethereum as a cornerstone of the crypto economy.

Ethereum Adoption Keeps Expanding Despite Market Doubts

The trend becomes clearer when filtering out dust wallets and abandoned addresses. Currently, the number of accounts holding at least $1 worth of ETH has pulled back slightly, reflecting some selling as prices climbed above $4,000.

At the same time, Ethereum quietly lost one of its ultra-large wallets containing more than 1 million ETH, a rare event given the concentration of coins at the very top. Despite these shifts, the overall picture remains bullish: Ethereum’s base of active and funded addresses has expanded consistently over the years, underscoring its resilience.

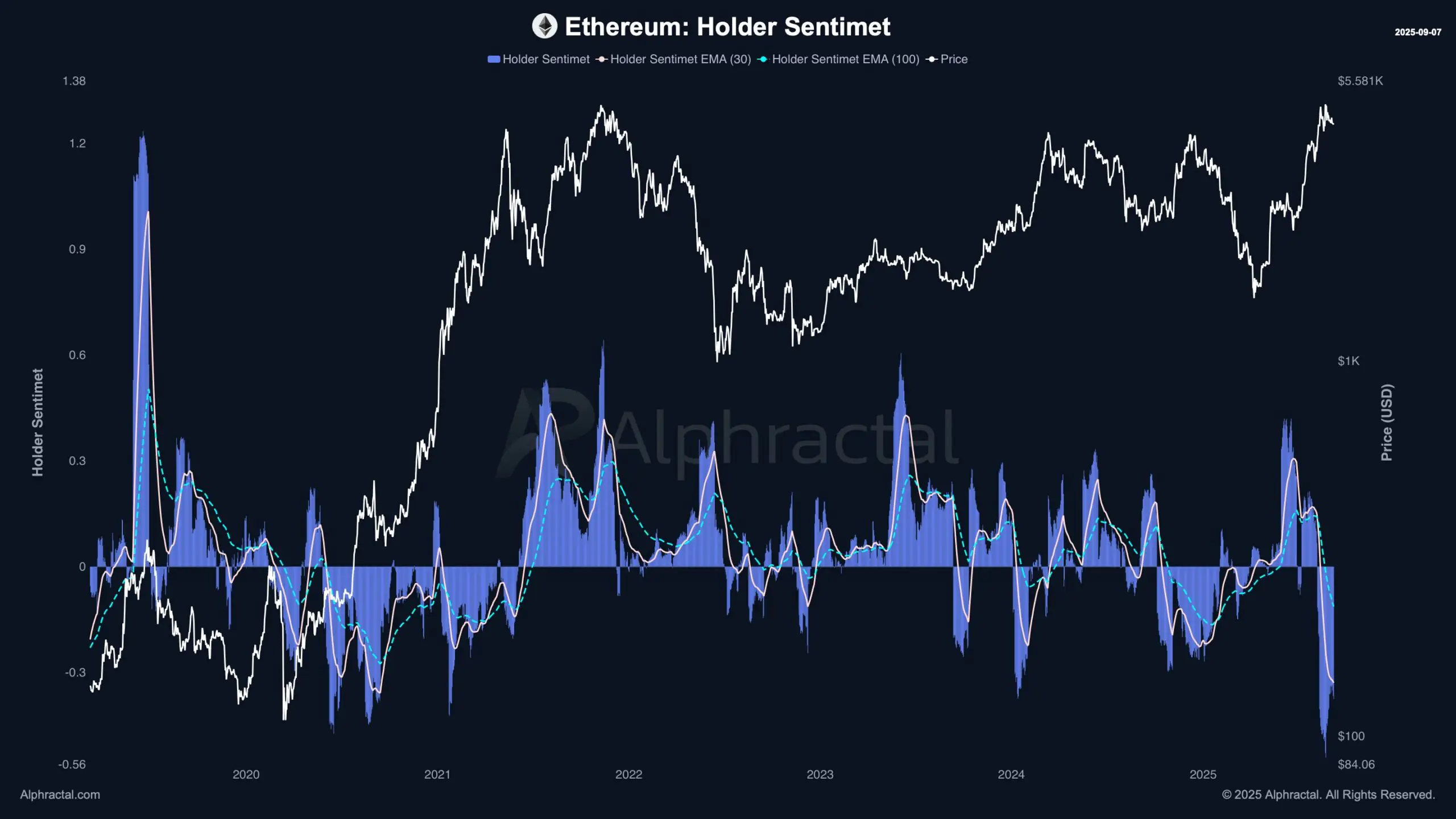

Holder Sentiment Falls to Lowest Level Since 2019

However, sentiment among holders is telling a different story. According to DarkFrost’s analysis, Ethereum’s holder sentiment index has dropped into its deepest negative territory since 2019.

This indicator measures the behavioral divide between short-term holders (STHs) and long-term holders (LTHs). A negative reading means that supply is flowing from seasoned investors toward newer entrants, typically signaling a more fragile market structure.

Historically, such sentiment drops have been followed by periods of heightened volatility. In past cycles, they have sometimes triggered sharp price corrections as newer investors proved more willing to sell under pressure. In other cases, the same conditions laid the groundwork for powerful rallies once selling pressure was absorbed. With Ethereum now trading above $5,500, the stakes are higher than ever.

What Comes Next for Ethereum

What remains clear is that Ethereum’s underlying adoption trend has not slowed. From DeFi protocols to NFT marketplaces and Layer-2 scaling solutions, the network remains one of the busiest ecosystems in crypto. Address growth confirms this continued expansion, even as sentiment data warns that the path forward may not be smooth.

Ethereum is therefore at a crossroads: its fundamentals and adoption metrics are strong, but its holder dynamics point toward possible instability. Investors and analysts will be watching closely to see whether the next move brings turbulence or yet another surprising recovery.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Millions of New Ethereum Wallets Created – Yet Investors Are More Bearish Than Ever appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·