TLDR

Ethereum trades at $4,294 with long-term holders taking profits as LTH NUPL reaches 0.65 ETF outflows totaled $787.6 million over four trading days during Labor Day week Coin Days Destroyed metric hit two-month high showing increased selling activity Price remains capped below $4,500 resistance with support at $4,222 Corporate treasuries now hold 2.97% of total ETH supply valued at $15.49 billionEthereum’s price recovery has stalled at $4,294 as long-term holders move to secure profits from recent gains. The selling pressure comes as US-based spot Ether ETFs recorded four consecutive days of net outflows during the shortened Labor Day trading week.

Ethereum (ETH) Price

Ethereum (ETH) Price

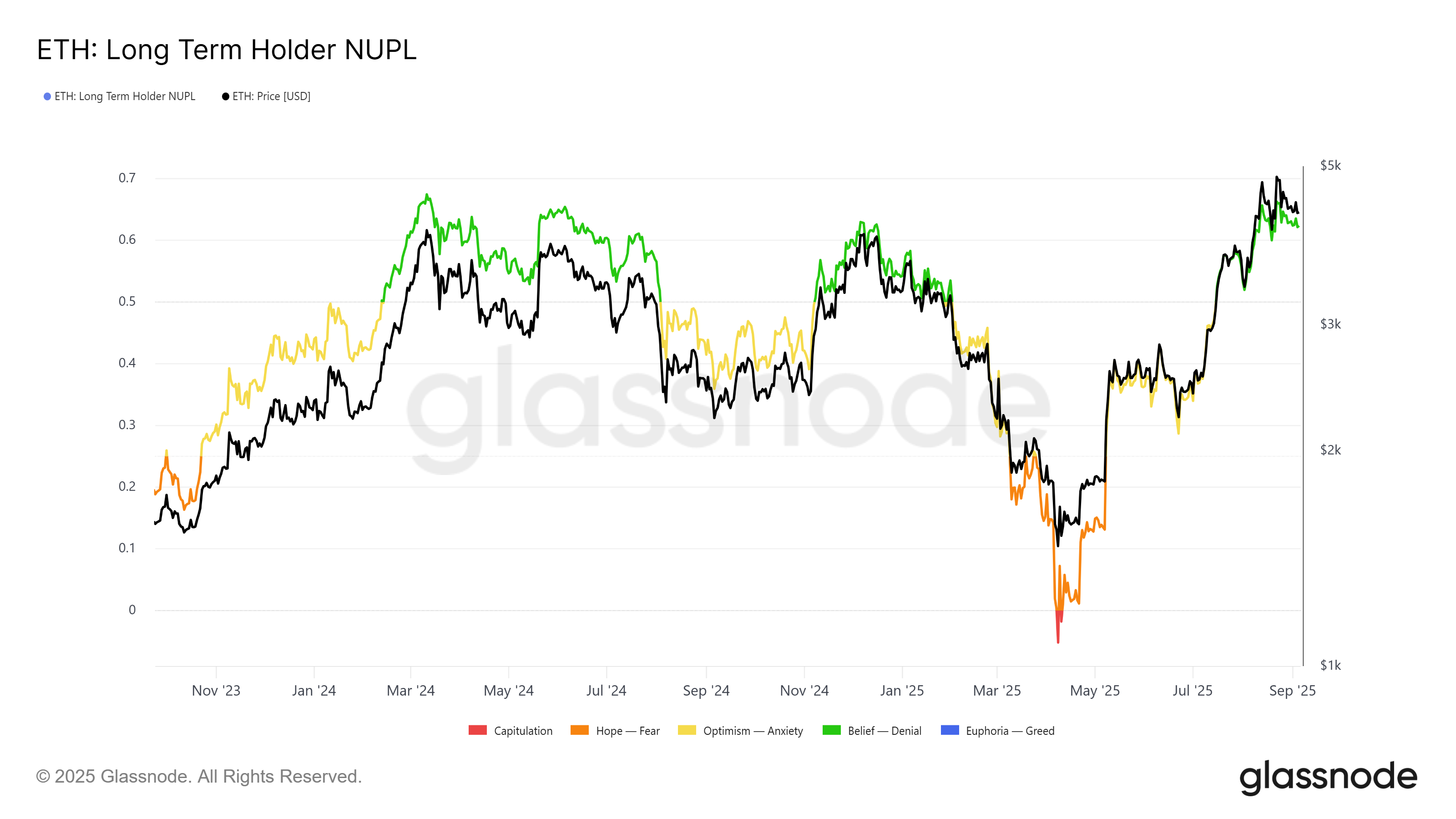

Long-term holder behavior has become a key factor limiting ETH’s upward movement. The LTH Net Unrealized Profit and Loss metric shows these seasoned investors are booking profits at current levels.

Source: Glassnode

Source: Glassnode

When this indicator crosses the 0.65 mark, Ethereum typically faces price headwinds. Past cycles show profit levels reach a saturation point where investors prefer to sell rather than continue holding.

The Coin Days Destroyed metric confirms this trend with its sharpest spike in two months. This data point tracks when long-term holders liquidate positions they have held for extended periods.

Such selling activity often precedes further downside pressure. The metric’s recent jump indicates a lack of confidence in immediate price recovery among established holders.

ETF Outflows Create Additional Pressure

Spot Ether ETFs posted $787.6 million in net outflows over the four-day trading period. Friday alone saw $446.8 million leave these investment vehicles.

$ETH ETF outflow of $167,300,000 yesterday.

I'm expecting inflows to return if Ethereum continues this pump. pic.twitter.com/4Evrfr8QLp

— Ted (@TedPillows) September 5, 2025

The outflows contrast sharply with August performance when Ether ETFs recorded $3.87 billion in net inflows. Bitcoin ETFs managed $250.3 million in net inflows during the same four-day period.

Crypto trader Ted expects inflows to return if Ethereum continues its price momentum. However, current selling pressure from multiple sources creates headwinds for near-term recovery.

The mixed institutional demand reflects broader uncertainty about ETH’s short-term direction. While August showed strong ETF appetite, September’s start suggests cooling institutional interest.

Ethereum Price Prediction

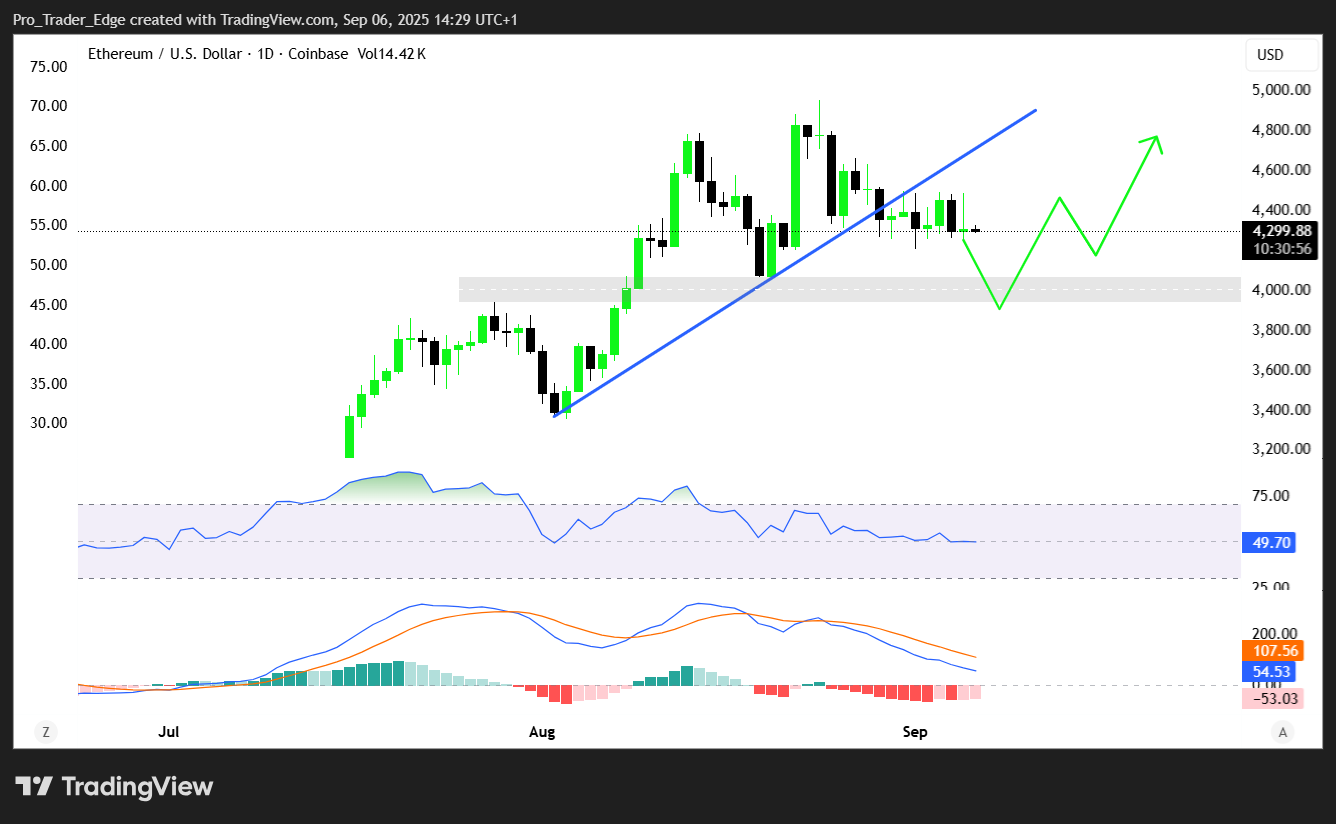

Ethereum faces resistance at $4,500 after multiple failed attempts to break above this level. The price has repeatedly rejected this ceiling over recent trading sessions.

Source: TradingView

Source: TradingView

Support sits at $4,222 which has held during recent weakness. This creates a defined trading range for ETH in the near term.

Without strong buying interest to absorb ongoing selling pressure, the range-bound action may continue. Market participants are watching for signs of renewed demand.

A successful break above $4,500 could target $4,749 as the next resistance level. However, this would require significant buying pressure to overcome current headwinds.

The technical setup suggests consolidation until market conditions shift. Either renewed institutional demand or reduced selling pressure could break the current pattern.

Corporate treasuries provide a counterbalance to the selling pressure. These entities now hold 2.97% of total ETH supply worth $15.49 billion at current prices.

BitMine remains the largest corporate holder with approximately $8.04 billion in ETH. Chairman Tom Lee maintains his long-term $60,000 price target despite current weakness.

Whale addresses holding between 1,000 and 100,000 ETH have increased holdings by 14% since April lows. This accumulation occurred as retail sentiment remained weak.

The corporate and whale buying provides underlying support but has not yet offset selling from long-term individual holders and ETF redemptions.

The post Ethereum (ETH) Price Prediction: Long-Term Holders Sell as ETF Outflows Continue for Fourth Straight Day appeared first on CoinCentral.

3 hours ago

3

3 hours ago

3

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·