TLDR

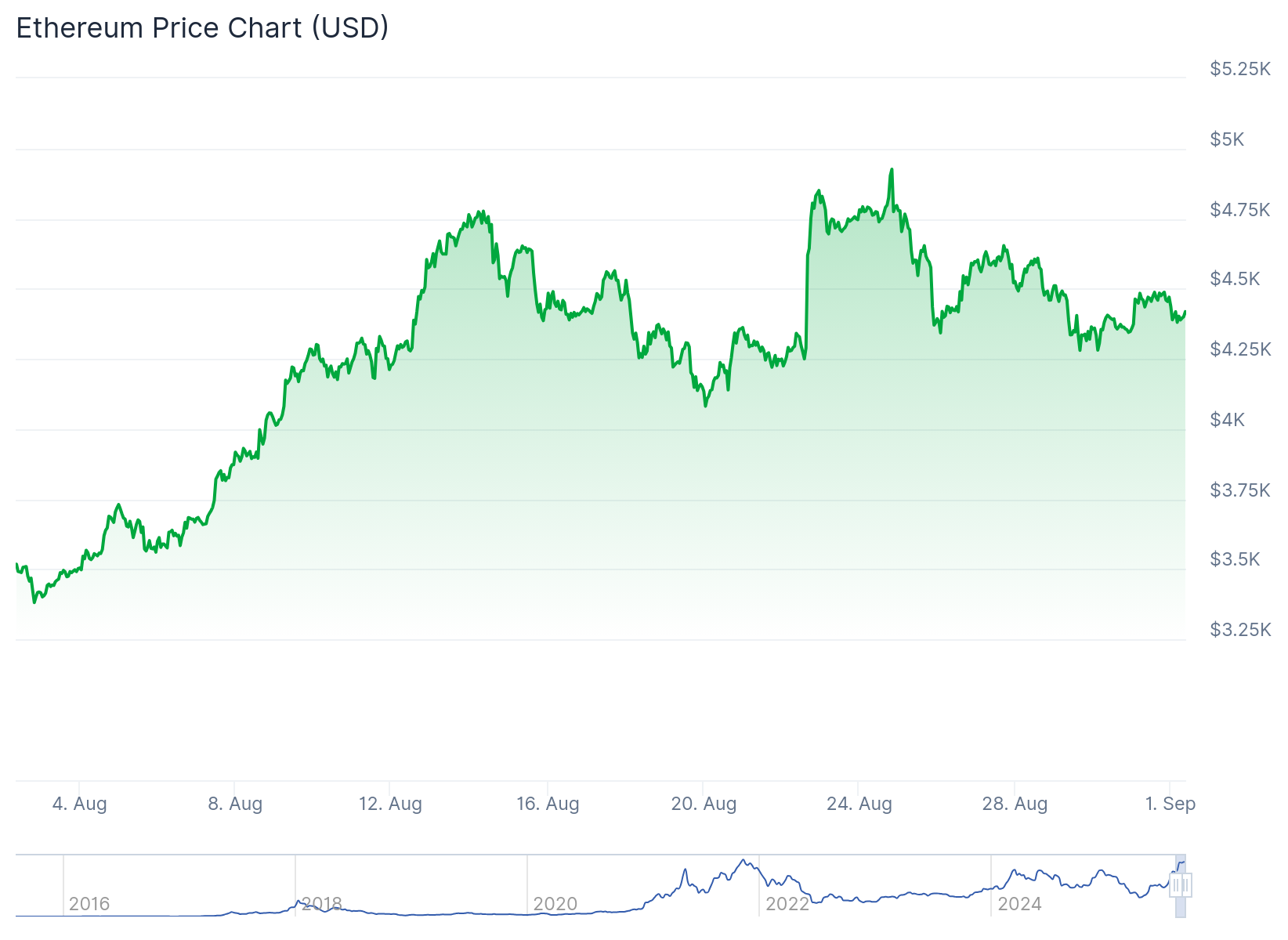

Ethereum (ETH) is trading around $4,460-$4,475, up over 2% as institutional demand drives price higher BlackRock’s Ethereum ETF attracted $968 million in weekly inflows, with ETFs accumulating nearly 5% of circulating supply Network activity reached multi-year highs with over 1.7 million daily transactions, highest on record Major Bitcoin whale purchased 820,224 ETH worth $3.6 billion in two weeks, showing institutional confidence Technical analysis suggests potential breakout to $5,100, though $4,000 retest remains possibleEthereum is trading around $4,460 to $4,475, posting gains of over 2% as institutional demand and network growth fuel upward momentum. The world’s second-largest cryptocurrency by market cap holds near record highs with a current valuation of approximately $536 to $541 billion.

Ethereum (ETH) Price

Ethereum (ETH) Price

BlackRock’s iShares Ethereum Trust ETF has attracted $968 million in net inflows during a single week. Since June, Ethereum ETFs and digital asset treasuries have accumulated nearly 5% of the total circulating supply.

#ETH now holds the 5th largest ETF spot in the US by inflows.

In August alone, $3.85B poured into BlackRock’s ETHA, a fund just 14 months old, hitting levels it usually takes other ETFs decades to reach.

The demand for Ethereum exposure is undeniable. pic.twitter.com/zVZl4s6xkk

— Crypto Patel (@CryptoPatel) September 1, 2025

This institutional accumulation has tightened exchange liquidity and sustained price momentum. BlackRock executives have positioned Ethereum as digital infrastructure alongside traditional asset classes.

The ETF approval and launch have been transformative for price action. Analysts argue that continued inflows could anchor Ethereum above $5,000 into the fourth quarter of 2025.

Network Usage Reaches New Records

Ethereum’s network activity has surged to multi-year highs. The 14-day simple moving average of total transactions surpassed 1.7 million in August, marking the highest level on record.

This exceeds the activity seen during the 2021 bull cycle. Active addresses have also reached a three-year high, confirming broad network participation across the ecosystem.

Decentralized exchange volume has surged alongside total value locked. DEX metrics are nearly revisiting the 2021 all-time high according to DeFiLlama data.

The key difference this cycle is transaction costs. Network fees have remained low despite the spike in usage thanks to recent protocol upgrades.

The Dencun upgrade in March 2024 and Pectra upgrade in May 2025 expanded blob throughput and improved validator efficiency. These structural improvements are sustaining adoption without cost increases that historically eroded momentum.

Whale Accumulation Signals Confidence

A major Bitcoin whale has shifted attention to Ethereum, purchasing over 820,224 ETH worth approximately $3.6 billion in just two weeks. This represents one of the largest institutional accumulation patterns seen recently.

🐳 THIS OG BITCOIN WHALE HAS BOUGHT 820,224 ETH WORTH $3.6 BILLION IN JUST 2 WEEKS.

HE DEFINITELY KNOWS SOMETHING 👀 pic.twitter.com/iG9Su2BGZE

— Ash Crypto (@Ashcryptoreal) August 31, 2025

The whale’s move signals strong confidence in Ethereum’s prospects. Analysts note that ETH has been outperforming Bitcoin in recent market shifts.

Derivatives market data shows mixed signals. Trading volume fell 14.29% to $61.71 billion, suggesting slower short-term participation,

Source: Coinglass

Source: Coinglass

However, open interest rose 2.94% to $60.75 billion. This indicates participants are holding positions and maintaining steady confidence in ETH’s direction.

Ethereum Price Prediction

Ethereum has tested and respected an ascending trendline since June 22. The price has bounced multiple times near the $4,265 to $4,300 support zone.

Source: TradingView

Source: TradingView

On August 30, ETH briefly dipped under $4,400, triggering $170.8 million in futures liquidations. Buyers stepped back in at trendline support levels.

The Relative Strength Index has stabilized at 51. The MACD is narrowing its negative spread, pointing to a potential bullish crossover.

Near-term resistance stands at $4,665. A breakout above $4,865 would open the path to the psychological $5,100 level.

Failure to hold the ascending trendline risks a retracement to $4,000. This level is reinforced by the 50-day moving average as key support.

The $4,100 to $4,300 zone remains critical for bulls to defend in the short term. Some analysts warn that a retest around $4,000 is still possible before further gains.

The Week Ahead: Bitcoin Investors Eye Jobs Report for Rate Cut Signals

The post Ethereum (ETH) Price Prediction: BlackRock ETF Attracts $968 Million in Weekly Inflows. What’s Next? appeared first on CoinCentral.

2 days ago

7

2 days ago

7

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·