Crypto absorbed its largest liquidation shock of 2025, with the heaviest single-day wipeouts since summer 2023 for ETH and SOL and the biggest since June for BTC, triggering a sharp, sentiment-driven downdraft across majors and large-cap altcoins. In a video analysis published today, analyst CryptoInsightUK urged restraint and argued that the move looks like a leverage flush rather than a structural break, pointing to liquidity maps, momentum gauges, and market-cap composites that, in his view, still skew constructive once the dust settles.

Do not rush and panic this morning,” he said at the outset. “The only rush and panic thing that you should be doing at this time is if you just want to buy spot… nothing has really changed at all.” He framed the sell-off against near-all-time-high closes last week across market-cap aggregates: Total2 (ex-BTC) “closed at about $1.66–$1.67 trillion,” Total3 (ex-BTC, ex-ETH) at “$1.13 trillion,” and total crypto market cap just shy of $4 trillion at “$3.96.” The message, he said, is to “zoom out,” assess structure, and watch for a familiar bottoming sequence that often follows abrupt long liquidations.

The analyst’s short-term roadmap hinges on a classic liquidity sweep plus momentum divergence. After a vertical wick clears resting bids and tripping stops, he looks for price to “chop,” revisit—and marginally undercut—the intraday low, while the RSI sets a higher low. “What we’re looking for structurally… is a higher low on the RSI, perfect if it’s in the oversold area… when we have a higher low on the RSI and a lower low in price action… the momentum of the selling is waning,” he said, calling this setup a reliable reversal tell “the higher the timeframe, the better.”

Crypto Watch: ETH, XRP, DOGE, ADA

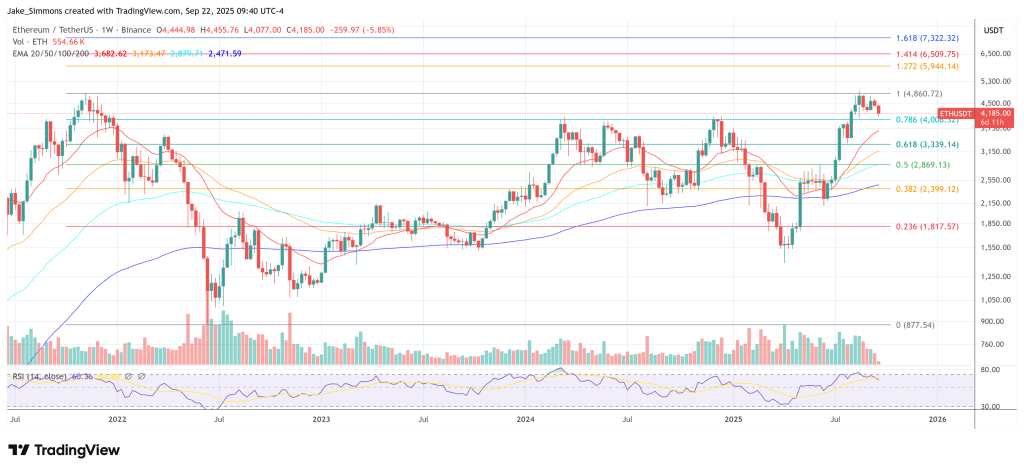

He cited fresh examples across majors. For ETH, a drawdown from “about $4,400 down to $4,000” knifed through a “dense” cluster of below-price liquidity that had accumulated for weeks. “This is the first time we’ve seen more liquidity above us than we have below since” the prior five-wave advance, he argued, consistent with an ABC correction that may be maturing.

XRP, he said, “pinpointed” its only notable pocket of sub-price liquidity, wicking to $2.66, a level he mapped against $2.8–$2.69. He now sees the “main liquidity… above us for XRP at $3.40, while allowing that a brief wick-fill toward today’s low could complete the divergence pattern he’s watching.

Bitcoin’s dominance spike during the flush also fits his playbook. He described the dominance RSI as “massively overbought… probably like on the hourly as overbought as I’ve seen it,” noting that prior forays into this zone have coincided with local peaks in BTC relative strength before rotation back into large caps and selective alts. That context—together with his “zoomed-out” view—underpins his claim that “bullish sentiment gets rewarded over time,” even if the path includes unnerving resets.

Dogecoin, he cautioned, can still probe the $0.19–$0.20 zone after reclaiming the $0.22 support region, but he flagged that the 4-hour RSI is as depressed as at prior cyclical lows. He disclosed a “2x” DOGE long around $0.225, acknowledging no hard stop given his conviction in the higher-timeframe trend and accepting the risk of further chop.

Cardano “wicked into” a mapped liquidity shelf near $0.77, with “main liquidity… up at $1.00 and $1.20” on the daily, a configuration he views as asymmetrically favorable once the market stabilizes.

What To Watch Now

Throughout, he emphasized that today’s damage was amplified by leverage, not fundamentals. “We’ve had a liquidity flush,” he said, referencing a social post he saw that “a billion dollars of leverage got flushed out in 30 minutes.” For him, that is “positive; we want to see this leverage reset.” He cautioned that near-term direction is hostage to US cash-market flows—“The US might wake up and… sell, or… buy the [dip]”—but insisted the larger structures are intact: “Weekly… we’re still sitting at all-time highs… Whether the top’s in or not, I don’t think so. I really, really, really, really, really don’t think so.”

His near-term checklist is straightforward: let volatility run its course, look for the RSI higher-low against a marginal price lower-low, and respect predefined support/target zones. “Take your emotion away and look for structures that you know are bottoming structures,” he said.

The trader psychology, in his telling, is as critical as the levels. “These things happen and it feels like a culmination of sentiment… anger, frustration, and now probably despair… If it’s too much… go for a run,” he advised, adding that “the market doesn’t care” about anyone’s mood and will “do what it’s going to do anyway.”

If the “real storm” is still to come, he implies it’s the post-flush move that matters—whether a final liquidity sweep completes the divergence or a swift rotation lifts majors into the overhead liquidity he’s mapped. Either way, he argues, the decisive phase is ahead, not behind: “Let’s see how things play out… It’s not a time to panic… If you want to be buying things… when we’re oversold like this, it’s a decent time to buy,” he said.

At press time, ETH traded at $4,185.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·