TLDR

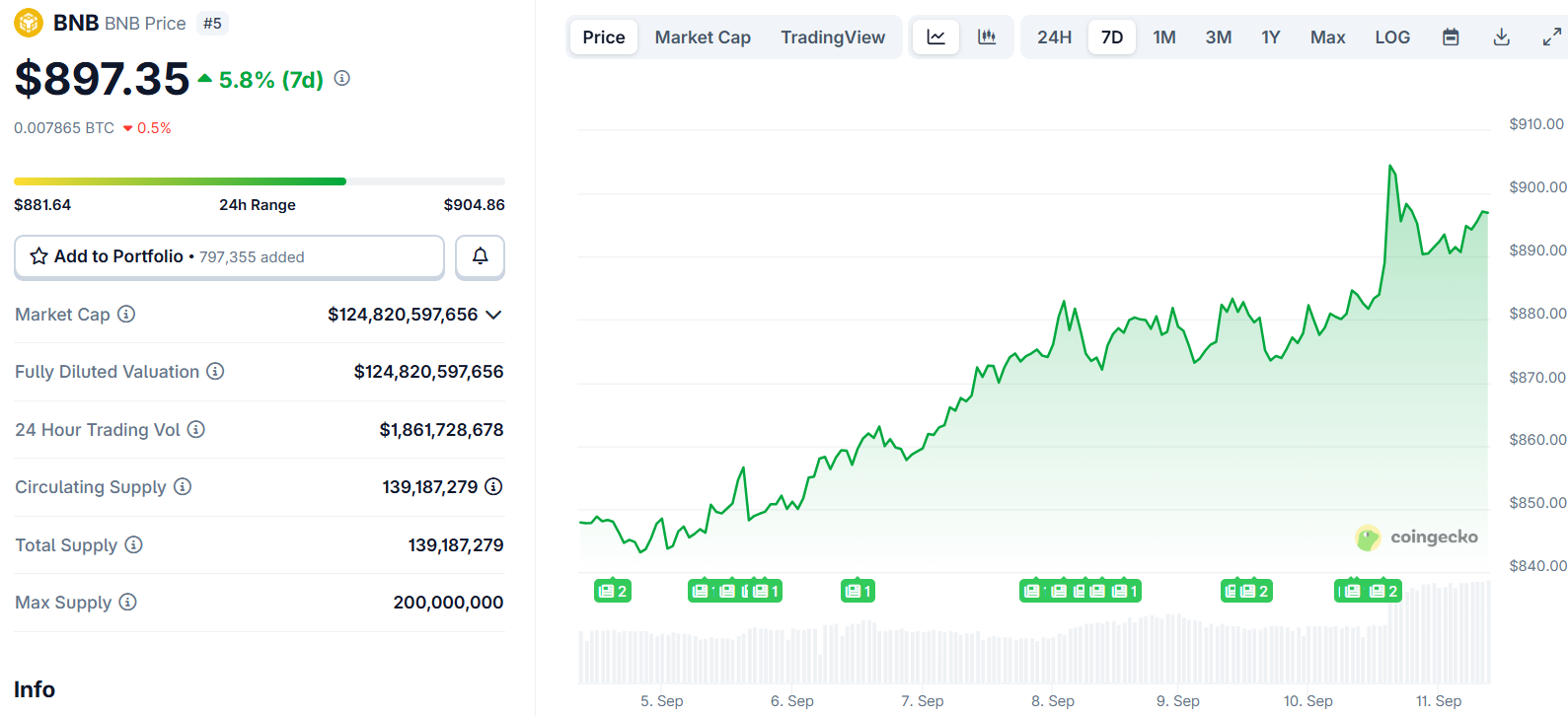

BNB reached a new all-time high of $904 driven by Binance’s partnership with Franklin Templeton Franklin Templeton manages $1.6 trillion in assets and will collaborate on securities tokenization programs CEA Industries added $26 million worth of BNB to its treasury, bringing total holdings to $368 million The company targets owning 1% of BNB’s circulating supply by end of 2025 BNB currently trades around $883 with strong whale activity near the $900 resistance levelBNB reached a new all-time high of $904 today before pulling back to current levels around $883. The price surge was triggered by two major developments in the BNB ecosystem.

BNB Price

BNB Price

Binance announced a strategic partnership with Franklin Templeton, a multinational investment management company with $1.6 trillion in assets under management. The collaboration focuses on developing digital asset programs that bridge traditional finance and blockchain applications.

#Binance is partnering with #FranklinTempleton @FTI_Global @FTDA_US to build tailored digital asset initiatives and institutional-grade solutions for a broad range of investors.

We are committed to making digital finance more accessible and reliable in TradFi while bridging… pic.twitter.com/V9YR7Kk6ip

— Binance (@binance) September 10, 2025

The partnership will integrate Franklin Templeton’s experience in compliant securities tokenization with Binance’s global trading platform. Both companies aim to create efficient and scalable products for a wide range of investors.

Roger Bayston, Head of Digital Assets at Franklin Templeton, said the focus was on moving tokenization from “concept to practice.” He noted that this enhances settlement, collateral management, and portfolio construction.

Sandy Kaul, Head of Innovation at Franklin Templeton, added that blockchain should be viewed as an opportunity to reimagine financial systems rather than a threat to existing models. Catherine Chen from Binance stated that the partnership would accelerate the integration of capital markets with BNB and other digital assets.

Corporate Treasury Accumulation Drives Demand

CEA Industries, traded on Nasdaq under the symbol BNC, recently purchased 30,000 BNB tokens worth approximately $26 million. This purchase brings the company’s total BNB holdings to 418,888 tokens valued at $368 million.

The latest acquisition follows a previous BNB treasury expansion worth $33 million. CEA Industries has positioned itself as one of the largest BNB corporate treasuries globally.

BNC has declared a goal to own one percent of BNB’s circulating supply by the end of 2025. If fully executed, including warrants that could add $750 million, the company’s treasury could exceed $1.25 billion.

CEO David Namdar described this effort as part of a larger $100-200 billion shift into digital asset treasuries. The corporate accumulation trend has provided strong buying pressure for BNB.

Technical Analysis Shows Consolidation

BNB currently maintains a market capitalization of $122.18 billion, securing its position as the fifth-largest cryptocurrency. Trading volume remains strong at $1.00 billion over 24 hours, indicating sustained interest from both institutional and retail participants.

Source: TradingView

Source: TradingView

Technical indicators suggest momentum is building for another potential breakout attempt. The Chaikin Money Flow indicator reads 0.09, showing mild but steady capital inflows into the asset.

The BBPower indicator stands at 30.27, signaling a recovery in bullish energy following recent consolidation. Buyers are actively defending the $870 support zone, which has served as a reliable floor during recent pullbacks.

The $896-$900 range represents the primary resistance level where sellers have repeatedly capped gains. A decisive daily close above this zone would signal renewed buyer dominance and potentially open the path toward higher targets.

BNB has established a pattern of higher lows since rallying from $820 earlier this month. Retracements have consistently been absorbed near $850 and $800 levels, reinforcing the bullish structure built on strong demand zones.

With a circulating supply of 139.18 million tokens, BNB remains central to the Binance ecosystem. The token has gained over 28% year-to-date, making it one of the top performers in 2025.

The post BNB Price: Hits All-Time High Following Franklin Templeton Partnership and Corporate Treasury Buying appeared first on CoinCentral.

4 hours ago

6

4 hours ago

6

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·