Despite technical headwinds, optimism remains that exchange-traded fund (ETF) inflows, long-term holder accumulation, and post-halving dynamics may soon tilt momentum in favor of the bulls.

Market Overview: Bitcoin Technical Analysis Signals Caution

Recent Bitcoin technical analysis paints a mixed picture. On the daily chart, BTC has formed a lower-high, lower-low pattern throughout August, signaling persistent sell-side momentum. Heavy red trading volumes have added to bearish pressure, and analysts caution that a breakdown below $107,000 could open the door to further declines.

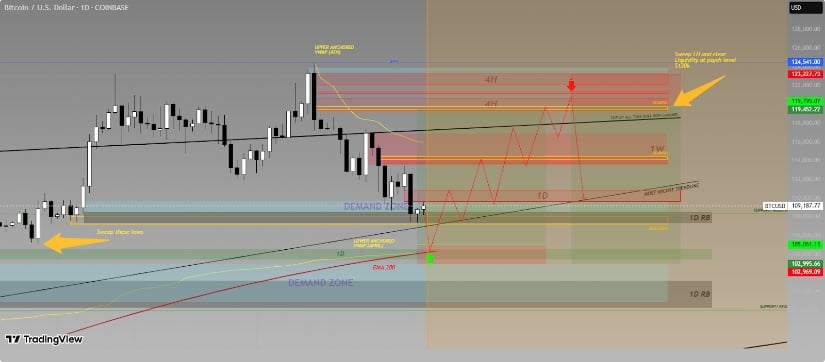

Bitcoin approaches key $108K support, with $120K liquidity in focus, suggesting a potential rebound but keeping short-term bearish risks in check. Source: SpartanTrader on TradingView

Shorter timeframes also reflect distribution patterns, with a descending triangle forming on the one-hour chart. Weak volume on upward moves indicates that sellers remain in control, while Bitcoin’s failure to sustain levels above $109,000 highlights the risk of a bear flag structure that could unravel if the $107,500 support breaks.

Still, oscillators hint at a potential rebound. The Bitcoin RSI indicator currently sits near 38, with the Stochastic at 10—levels typically associated with oversold conditions. Similarly, the Commodity Channel Index (CCI) at -118 flashes a short-term bullish divergence. If these signals play out, BTC could mount a relief rally toward $114,000.

Halving, ETFs, and Whale Activity Shape the Bigger Picture

Beyond the charts, fundamental catalysts remain in play. The Bitcoin halving of April 2024 cut miner rewards from 6.25 BTC to 3.125 BTC, tightening supply just as institutional demand accelerates. U.S. spot Bitcoin ETF news continues to fuel optimism, with BlackRock’s IBIT ETF managing more than $57 billion in assets and analysts projecting ETF holdings could reach 7% of circulating supply by year-end.

BlackRock CEO Larry Fink says the Bitcoin ETF is the fastest-growing ETF in history. Source: Bitcoin Archive via X

At the same time, Bitcoin whale alert data shows large investors steadily accumulating coins. This accumulation trend, combined with record-high long-term holder balances, signals growing conviction that Bitcoin remains a hedge against both inflation and geopolitical risks.

However, macro factors cannot be ignored. The Federal Reserve’s delayed rate cuts and heightened global uncertainty—ranging from U.S. trade disputes to Middle East tensions—have dampened risk appetite across asset classes. These headwinds could limit any near-term breakout.

Expert Insights: Bulls vs. Bears

Forecasts for September 2025 remain sharply divided. Standard Chartered and Bernstein both see Bitcoin climbing toward $200,000 by year-end, with September acting as a potential springboard if $114,000 breaks. CoinDCX analysts suggest BTC could reach $125,000–$128,000 if it holds above key supports.

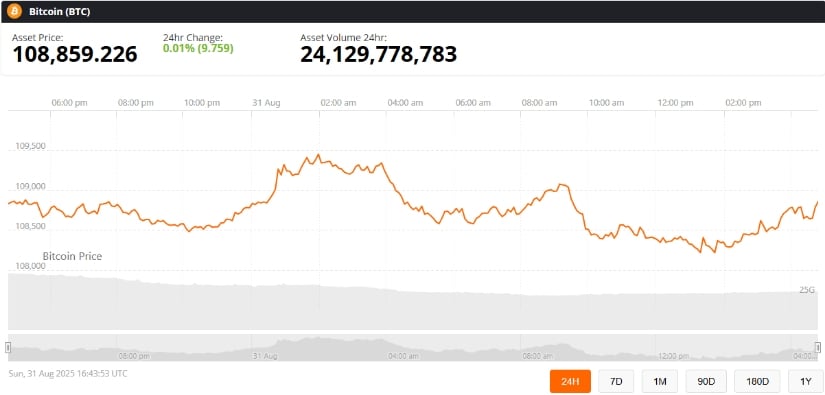

Bitcoin was trading at around $108,859 at press time. Source: Bitcoin Price via Brave New Coin

In contrast, more cautious voices warn of deeper corrections. Charting Guy argues that “failure to reclaim $95,000 could extend Bitcoin’s bearish phase.” Longforecast models predict an average price near $104,000 in September, with risk of sliding toward $90,000 under adverse conditions.

Meanwhile, algorithm-driven forecasts like CoinCodex project a more balanced outcome, calling for $116,622 by late September—a modest 7% rise from current levels.

The Road Ahead: BTC’s Next Move

With Bitcoin hovering just above key support, the coming weeks may determine whether oversold signals translate into a sustainable recovery. A confirmed daily close above $114,000 could mark the first step toward a bullish reversal, while a breakdown below $107,000 risks accelerating the downtrend.

Bitcoin’s bullish structure remains intact, with momentum preserved despite a deep pullback and no invalidation of key lows. Source: Juicemann on TradingView

For now, the most probable scenario appears to be consolidation between $105,000 and $115,000, with ETF inflows and whale accumulation providing a cushion against steeper losses. Longer term, Bitcoin’s supply squeeze, political backing in the U.S., and its growing role as an inflation hedge continue to underpin a bullish narrative.

As always, volatility remains a defining feature of crypto markets. Investors are advised to monitor ETF flows, Fed policy signals, and whale activity closely as Bitcoin navigates this pivotal period.

3 days ago

4

3 days ago

4

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·