TLDR

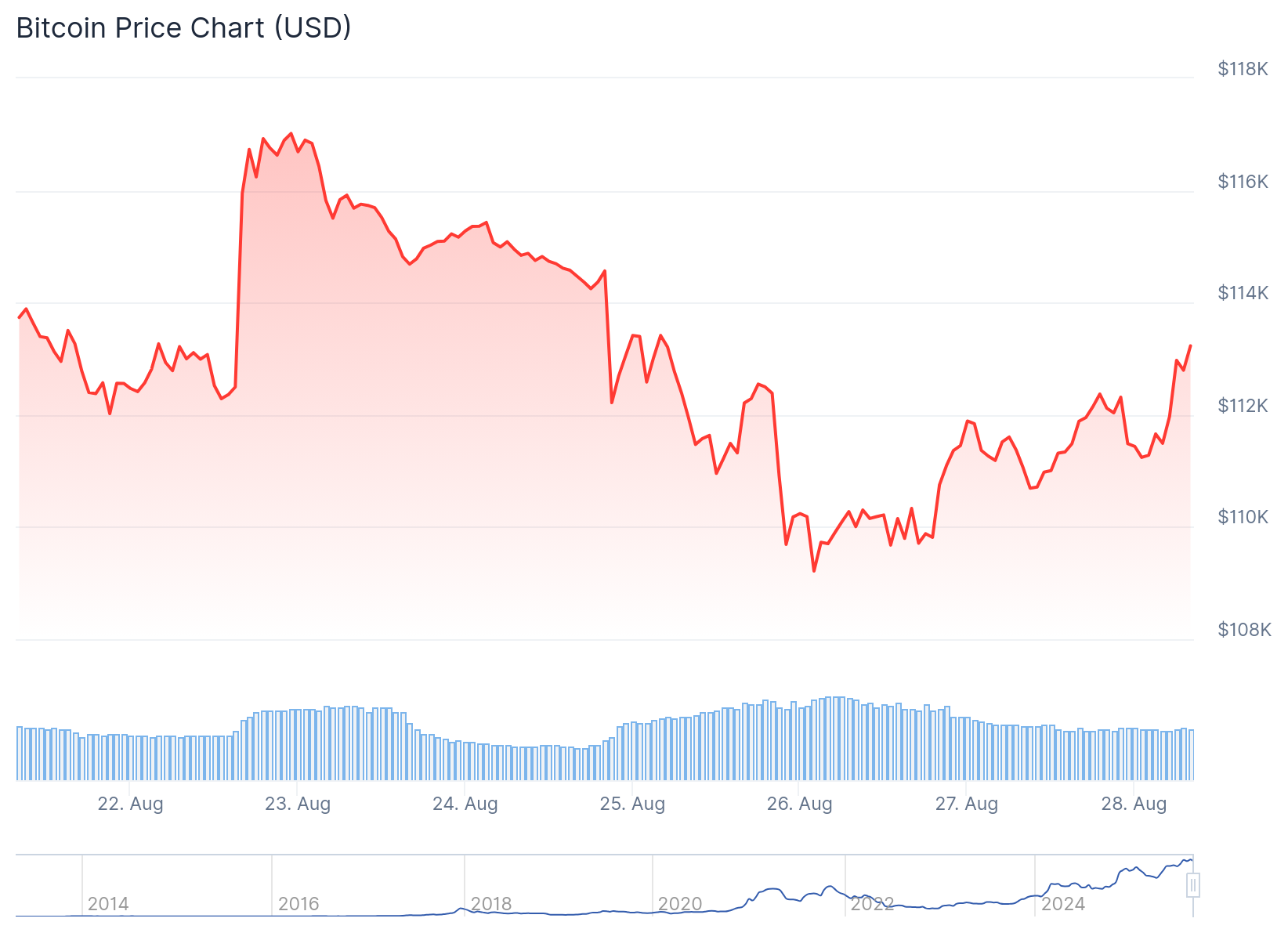

Bitcoin trades near $113,000 after hitting seven-week lows below $109,000 earlier this week Retail traders are aggressively buying the dip while whale and institutional investors remain net sellers Federal Reserve rate cut expectations are supporting crypto markets with 85% probability of September cut Bitcoin has fallen over 10% from its August record high above $124,000 Political uncertainty emerges as Trump fires Fed Governor Lisa Cook over mortgage fraud allegationsBitcoin price is showing signs of recovery as the cryptocurrency trades around $113,000 on Thursday. The world’s largest digital asset hit seven-week lows below $109,000 earlier this week but has managed to climb back from those depths.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The recent price action reveals a clear divide between different types of investors. Data from trading platforms shows retail traders have been buying aggressively during the recent correction. These smaller investors, typically trading between $1,000 and $10,000, have been net buyers throughout the weekend selloff.

Whale and institutional traders tell a different story. Investors with positions between $1 million and $10 million have been net sellers during the same period. This selling pressure from larger players has prevented Bitcoin from staging a stronger recovery despite retail support.

The data shows retail volumes on Coinbase reached $101.253 million in net buying. Meanwhile, institutional investors across Binance and Coinbase have been net sellers. Perpetual futures markets saw roughly $7.5 billion in selling during the correction timeframe.

Federal Reserve Policy Shifts Market Focus

Market attention has shifted toward potential Federal Reserve policy changes. Traders are pricing in roughly an 87% chance of a quarter-point interest rate cut in September. Lower interest rates typically benefit risk assets like Bitcoin by reducing the opportunity cost of holding non-yielding investments.

🇺🇸 FED WILL CUT RATES IN SEPT

ODDS ARE NOW 87%🔥

THESE DUMPS ARE JUST TO SCARE

YOU SO THE BIG MONEY CAN LOAD

THEIR BAGS BEFORE MARKET GOES

INTO PARABOLIC PHASE pic.twitter.com/ktDCx2nJKO

— Ash Crypto (@Ashcryptoreal) August 27, 2025

The cryptocurrency market is also processing political developments from Washington. President Trump announced the firing of Fed Governor Lisa Cook on Tuesday. The dismissal came over allegations of mortgage fraud related to 2021 loan documents.

Cook disputes the allegations and her lawyer plans to challenge the dismissal in court. The legal team argues the firing violates the Federal Reserve Act and lacks proper legal grounds.

Bitcoin’s recent decline represents a pullback of more than 10% from its August record peak above $124,000. The cryptocurrency had been trading in a range between $117,000 and $118,000 before the weekend selloff began.

Liquidation data reveals clusters of positions around key price levels. A concentration of bids exists between $111,000 and $110,000 from the weekend selloff. Another cluster sits near $104,000, though a breakdown to those levels appears less likely given current market dynamics.

Bitcoin Price Prediction

The current price structure shows Bitcoin remains in a short-term downtrend despite positive buying from smaller traders. The divergence between retail buying and institutional selling creates an uncertain environment for price direction.

Volume data indicates retail traders believe they are buying Bitcoin at discounted levels. Many appear to be betting on a quick return to the $117,000 to $118,000 range. However, continued selling pressure from larger investors is limiting upside momentum.

Source: TradingView

Source: TradingView

The market will be watching for changes in this dynamic. A shift in institutional sentiment could align with retail buying to support a stronger recovery. Conversely, continued whale selling could pressure prices lower despite retail support.

Friday’s release of the personal consumption expenditures price index will provide new data on inflation trends. The PCE is the Federal Reserve’s preferred inflation measure and will influence September policy decisions.

Current trading shows Bitcoin up 1.7% to $112,869.5 as of early Thursday morning, with the cryptocurrency attempting to distance itself from this week’s lows while facing continued headwinds from mixed investor sentiment.

The post Bitcoin (BTC) Price Prediction: Retail Buying Meets Institutional Selling Pressure at $113,000 appeared first on CoinCentral.

4 days ago

2

4 days ago

2

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·