TLDR

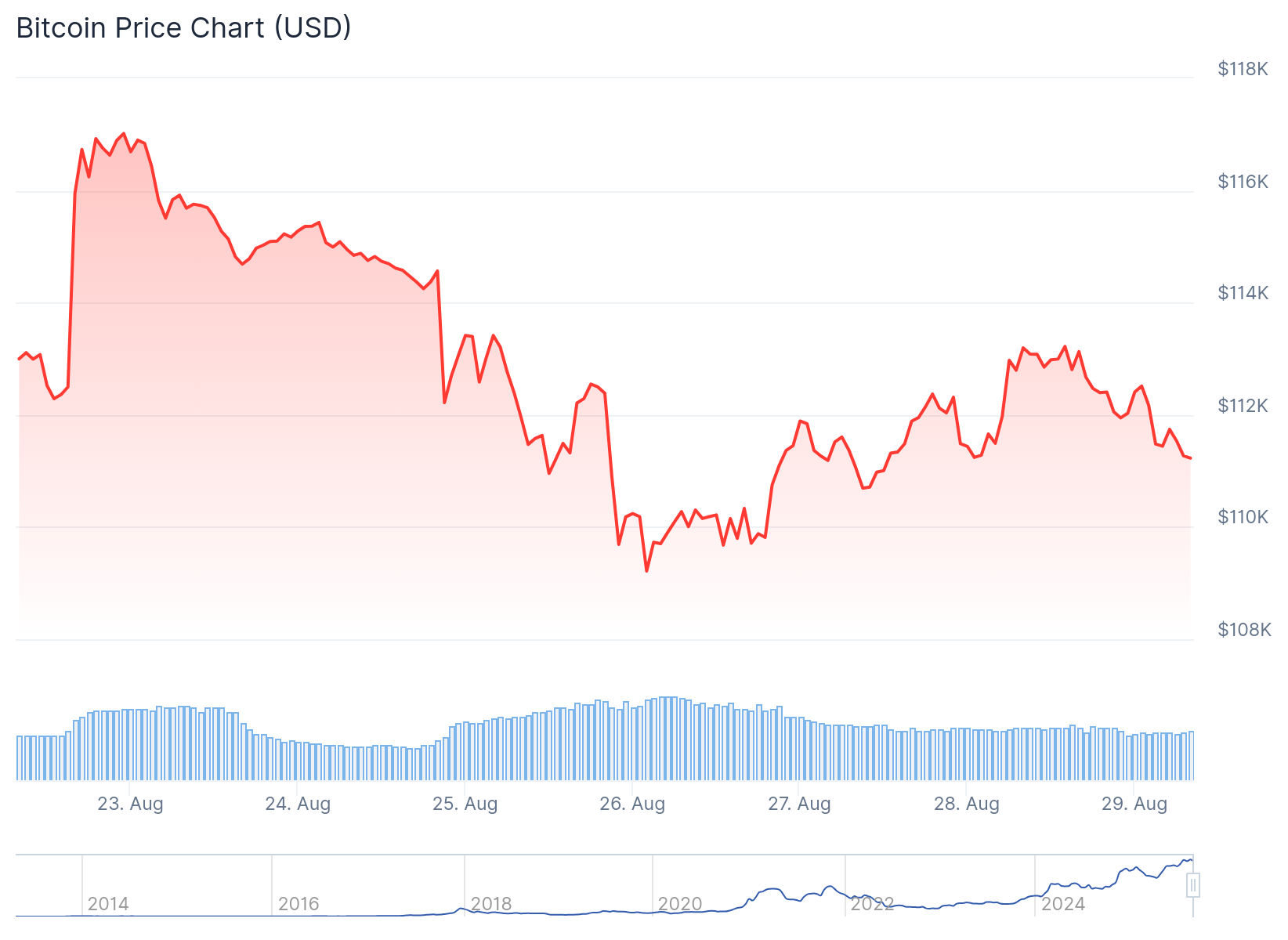

Bitcoin’s volatility has fallen from 60% at the start of 2025 to a record low of 30% JPMorgan believes Bitcoin is undervalued by approximately $16,000 compared to gold Corporate treasuries now hold over 6% of Bitcoin’s total supply The bank’s models suggest Bitcoin price could reach $126,000 to match gold’s valuation Veteran trader Peter Brandt warns of potential crash if Bitcoin fails to reclaim $117,570 levelBitcoin price is trading at $111,264 while JPMorgan argues the cryptocurrency remains undervalued compared to gold. The Wall Street bank released a research report highlighting how Bitcoin’s volatility has dropped to historic lows.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The six-month rolling volatility for Bitcoin has fallen from nearly 60% at the beginning of 2025 to about 30% currently. This represents the lowest volatility reading on record for the digital asset.

With volatility moving closer to gold levels, Bitcoin is now only twice as volatile as the precious metal. This marks the lowest ratio between the two assets ever recorded.

JPMorgan just admitted bitcoin at $112k is undervalued versus gold.

Bitcoin would be $1.17M if it was the size of gold today.

When will bitcoin reach gold parity, and how much will it be worth?

[B2YB @JoinHorizon_] pic.twitter.com/GvofTvKEef

— Joe Consorti ⚡️ (@JoeConsorti) August 28, 2025

JPMorgan’s analysts believe this volatility convergence makes Bitcoin increasingly attractive for institutional investment portfolios. The bank’s volatility-adjusted models suggest Bitcoin’s market cap needs to rise 13% to match gold’s $5 trillion in private investment.

This calculation implies a Bitcoin price target of approximately $126,000. According to JPMorgan’s analysis, Bitcoin currently trades about $16,000 below its fair value relative to gold.

The research team led by Nikolaos Panigirtzoglou attributes the volatility decline to growing corporate treasury adoption. Corporate treasuries now control more than 6% of Bitcoin’s total supply.

Corporate Adoption Drives Stability

The analysts compare this phenomenon to how central bank quantitative easing previously reduced bond market volatility. Corporate Bitcoin purchases are creating a similar stabilizing effect on cryptocurrency markets.

Index inclusion is driving passive capital flows into Bitcoin-related investments. Companies like Metaplanet received upgrades into FTSE Russell’s mid-cap category and addition to global benchmarks.

Nasdaq-listed Kindly MD is raising up to $5 billion following a $679 million Bitcoin purchase. New market entrants are also building treasury positions to compete with established players like MARA Holdings and MicroStrategy.

However, not all market observers share JPMorgan’s optimistic outlook. Veteran trader Peter Brandt has expressed concerns about Bitcoin’s recent price action and potential bearish patterns.

Bitcoin Price Prediction

Brandt points to a double-top pattern formation that could signal further price declines. He believes Bitcoin needs to recover above $117,570 to negate the negative technical setup.

Most of you crypto nerds know about the huge sell order that came into the $BTC market over the weekend. Some of you discount it as unimportant. I am not so quick to judge that. It represented SUPPLY. Tops in markets are created by SUPPLY or DISTRIBUTION. BTC needs to get back… pic.twitter.com/TWEoYGkaYK

— Peter Brandt (@PeterLBrandt) August 27, 2025

Bitcoin has declined more than 12% from its all-time high of $124,457 to recent lows around $108,762. This selloff has contributed to broader cryptocurrency market cap losses exceeding $400 billion.

On-chain data reveals continued selling pressure from large holders. A Bitcoin whale known as “bc1qlf” recently sold another 750 BTC worth $83.11 million through Binance.

The same whale has liquidated 1,750 BTC worth $189.3 million at an average price of $108,160. This represents part of a 5,000 BTC position originally purchased for $1.66 million when Bitcoin traded at $332.

Source: CryptoQuant

Source: CryptoQuant

CryptoQuant data shows the 30-day moving average of the Taker Buy/Sell Ratio has dropped to its lowest level since May 2018. This metric suggests continued selling pressure may persist in the short term.

Bitcoin price recovered above $112,000 on Wednesday as buyers stepped in during the dip. Trading volume decreased by 19% in the last 24 hours as market participants remained cautious about near-term direction.

The post Bitcoin (BTC) Price Prediction: JPMorgan Says BTC Undervalued Versus Gold as Volatility Drops to Record Low appeared first on CoinCentral.

5 days ago

8

5 days ago

8

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·