While making up a fairly small percentage of the total crypto market cap – $305B of $4T – stablecoins are rapidly becoming of the most appealing use cases for institutional and retail investors alike.

A new report from EY-Parthenon highlights just how rapidly stablecoins have become a backbone of the decentralized financial system, promising improved speed, reduced cost, and enhanced liquidity as part of a new global payments system.

Growing Adoption and Projections

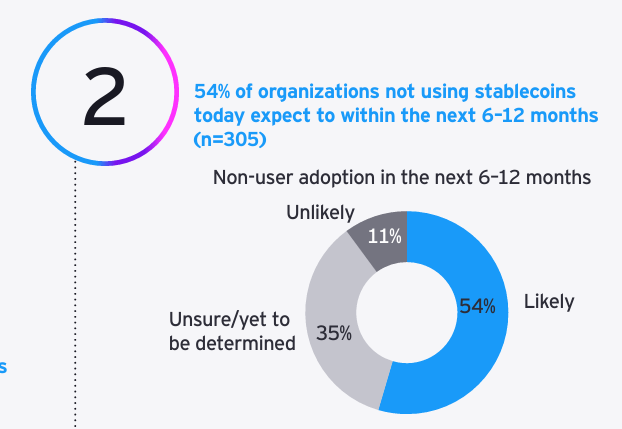

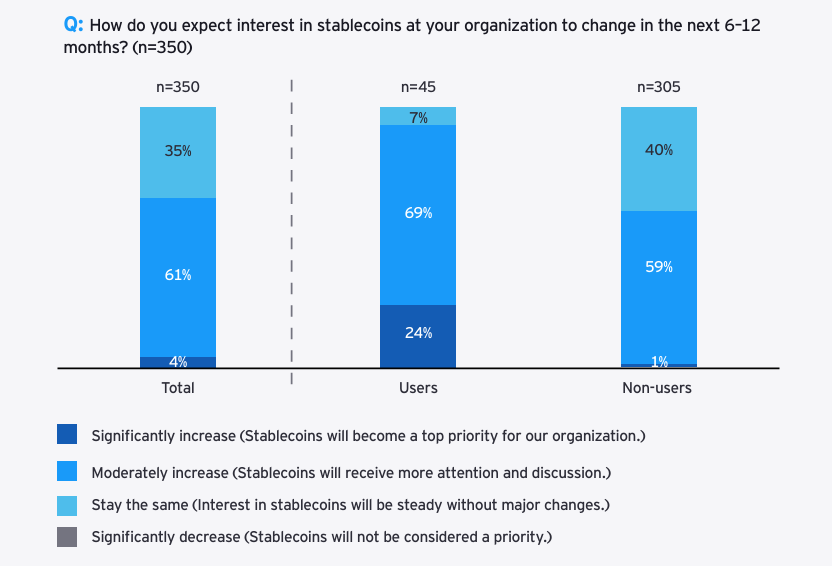

EY-Parthenon’s latest survey reveals that 13% of corporations and financial institutions worldwide currently use stablecoins. Meanwhile, over half of non-users expect to adopt stablecoins in the next 6 to 12 months.

In terms of impact, the report forecasts that by 2030, stablecoins will account for 5-10% of all cross-border payments, representing a total value between $2.1-$4.2T.

Why the rush to stablecoins? Current adopters highlight crypto’s advantages, with 41% reporting cost savings of at least 10%. Key drivers for this interest? Faster settlement times, lower transaction costs, and better liquidity management.

Nubank Spurs Latin America’s Adoption of Crypto Payments

The shift from storing value in crypto to spending it in Latin America is already underway.

Nubank, a leading digital bank serving over 100M customers across Brazil, Mexico, and Colombia, has announced plans to test stablecoin payments via credit cards.

Nubank’s initiative aims to change that, but the initiatives will require the cooperation of the central bank to ensure that Nubank can accept tokenized deposits, among other challenges.

Nubank’s interest – and its interest in making stablecoins more appealing to other investors – fits in neatly with EY-Parthenon’s findings.

While interest is high, adoption faces clear obstacles:

Infrastructure and Integration: Many corporations signal that they would adopt stablecoins only if they can embed APIs, integrate with existing treasury systems, or plug into ERP platforms. That explains comparatively low rates of adoption – currently, only 8% of corporates accept stablecoins. Regulatory Clarity: Legal and regulatory frameworks are still catching up. Laws like the GENIUS Act are seen as milestones, but even the US – increasingly a crypto-front-runner – intends to implement several additional pieces of legislation for further clarification. Utility Barriers: As Latin America shows, users must shift from buying stablecoins as stores of value toward using them for payments.Just like fiat currencies, regularly using crypto requires a good crypto wallet. That’s where Best Wallet comes in.

Best Wallet Token ($BEST) – Non-Custodial, Cutting-Edge Crypto Presale Wallet

Best Wallet offers an accessible, secure way for experienced and new users alike to jump into crypto. Like all wallets, you can use Best Wallet to buy, sell, swap, and store your crypto.

But unlike other wallets, Best Wallet also offers the Best Wallet Token ($BEST). With $BEST, you can unlock a whole range of added benefits, including:

Lower transaction fees Higher staking yields Early crypto presale access

$BEST is a true utility token, allowing holders to get more from their wallets. And that’s not all the Best Wallet has to offer – there’s a planned Best Card in the works to make spending your crypto easier than ever, tackling the exact problem highlighted by Nubank and EY-Parthenon.

The Upcoming Tokens section of the Best Wallet app offers early access to some of the hottest crypto presales. Discover new projects, research tokenomics, read whitepapers, and gather all the information you need to make an informed decision – all without leaving Best Wallet.

Visit the token presale page to learn more.

Looking Ahead: What to Expect from Stablecoins

By 2030, stablecoins are projected to account for billions and trillions of dollars in cross-border payments. For banks, corporates, and fintechs, this means major opportunities: lower costs, faster settlement, new product offerings, and more global reach.

The stablecoin story is no longer about what might happen – it’s increasingly about what is happening as stablecoins become central to the future of global payments.

2 hours ago

2

2 hours ago

2

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·